The federal election is only a few days away.

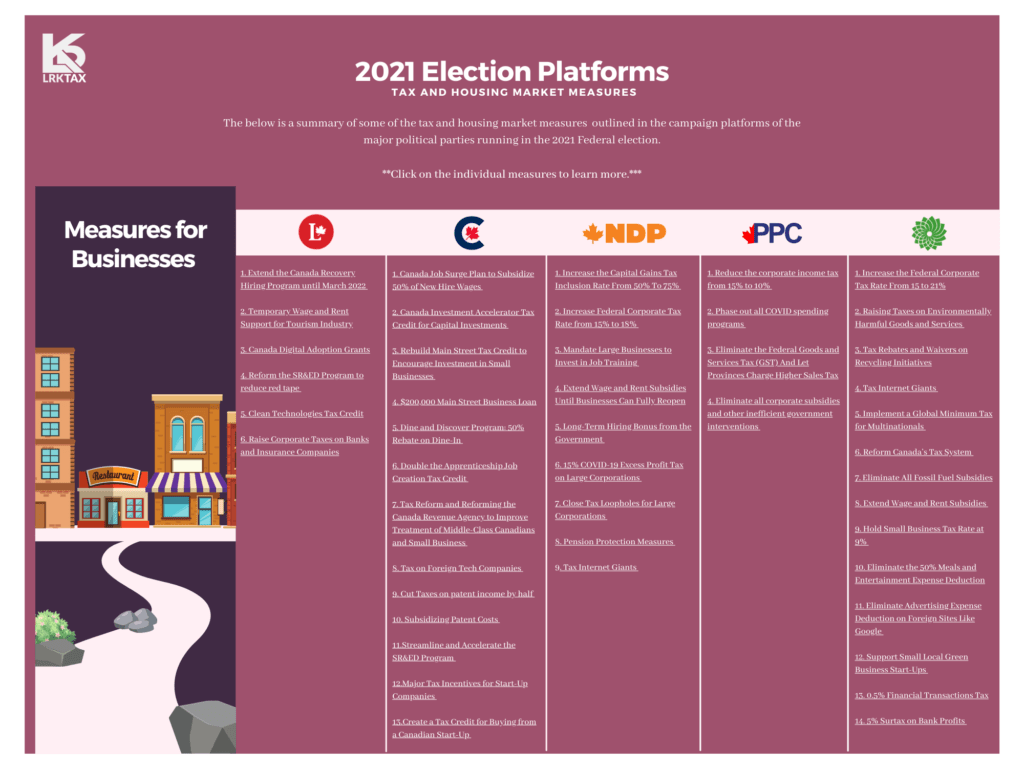

The below is a summary of all the tax and housing market promises by Canada’s major political parties.

Click the below image for more details.

Take the first step toward success!

If you have questions or need expert guidance, we’re here to help you every step of the way. Schedule your free consultation today!