What is the CEWS?

- The Canada Emergency Wage Subsidy (CEWS) would apply at a rate of 75% of the first $58,700 normally earned by employees – representing a benefit of up to $847 per week per employee[1].

What period does the subsidy cover?

- The program would be in place for 12 weeks, from March 15 to June 6, 2020.

Who qualifies & 30% Revenue Decline Test

- All private-sector employers of all sizes and across all sectors of the economy. Individuals, corporations, and partnerships.

- Eligible employers must suffer a drop in gross revenues of at least 30% in March, April or May when compared to the same month in 2019.

- Employers would be required to attest to the decline in revenue.

- For non-profit organizations and registered charities similarly affected by a loss of revenue, the government will work on coming up with a definition of revenue for this sector. This could be a loss in donations compared to the previous year. For instance, many places of worship have lost contributions due to social-distancing measures.

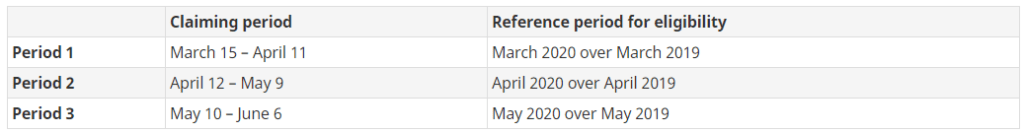

Reference period for comparing year-over-year revenues

- compare it to the corresponding month in which the benefit period began.

- Here’s a useful chart from Finance Canada:

What if I am a new business? What’s my reference point?

- For new employers established after February 2019, eligibility would be determined by comparing monthly revenues to a “reasonable benchmark.”

- Hopefully, Finance Canada provides more guidance on what’s a reasonable benchmark.

Calculating Revenues

- Revenue = revenue from its business carried on in Canada from arm’s-length sources.

- Calculated using the employer’s normal accounting method

- Excludes revenues from extraordinary items and amounts on account of capital.

Calculating Amount of the Subsidy

Greater of:

- 75% of the amount of remuneration paid, up to a maximum benefit of $847 per week; and

- the amount of remuneration paid, up to a maximum benefit of $847 per week or 75% of the employee’s pre-crisis weekly remuneration, whichever is less.

How do I compute pre-crisis weekly remuneration?

- Further guidance to be provided in the coming days.

- Employers can receive a benefit equal to 75% of pre-crisis wages. Employers are expected to top up the remaining 25%. However, there is no penalty for failing to top up employees. Based on trust and good faith.

How do I compute remuneration?

- Remuneration includes salary, wages, and other remuneration which employers would generally be required to withhold tax on.

- It does not include severance pay, stock option benefits, or the automobile benefits from personal use of a corporate vehicle.

Can owner-managers take advantage of CEWS on their own salaries?

- It seems to be the case based on information released thus far, but with further conditions.

- A special rule will apply to employees that do not deal at arm’s length with the employer (i.e., the corporation).

- The subsidy amount for such employees will be limited to:

- the eligible remuneration paid in any pay period between March 15 and June 6, 2020,

- up to a maximum benefit of $847 per week or 75% of the employee’s pre-crisis weekly remuneration.

- We need to wait and see how the government will define pre-crisis weekly remuneration.

Is there a limit on the subsidy a business can receive?

- no overall limit on the subsidy amount that an eligible employer may claim

When and how can I apply?

- Minister Morneau stated that an online portal will open in 3 to 6 weeks on the CRA Website. Payment should be deployed at the latest by 6 weeks.

How will I get paid?

- Unlike the previously announced 10% subsidy (see below – this program is still available) where you could have remitted less taxes on payroll source deductions, this new 75% Subsidy is directly paid by the government (via CRA).

- Minister Morneau encouraged small businesses to set up direct deposits to receive payments faster.

- Since the application is through the CRA online portal, make sure to register for direct deposits to get the subsidy faster.

Penalties

- Minister Morneau warned that if this money is used for fraudulent purposes, they will face severe penalties.

- Anti‑abuse rules will be proposed to ensure that the subsidy is not abused and to ensure that employees are paid the amounts they are owed.

- Appears that penalties for offences will be very strict and not worth testing.

Can I still apply for the old 10% Temporary Wage Subsidy?

- If you do not qualify for the CEWS, you may qualify for the previously announced Temporary Wage Subsidy of 10% of wages paid from March 18 to before June 20, up to a maximum subsidy of $1,375 per employee and $25,000 per employer.

- Check out our free calculator.

- If you’re eligible for both programs, then any benefit from the 10% Wage Subsidy will reduce the benefit available under CEWS in the period of application.

Can I get CEWS if my Employee is eligible for the Canadian Emergency Response Benefit (CERB)?

- CEWS application is for a 4-week period.

- If an employee is eligible for the CERB during that 4-week period, then the employer cannot claim the CEWS on wages paid to that employee in that same period.

- For example:

- ABC Inc. told Mary to not work 14 consecutive days in the period April 12 to May 9. She worked on the other days in this period and received wages.

- Mary applies for CERB for the same period.

- ABC inc. is not eligible for CEWS relief on wages paid to Mary from April 12 to May 9.

- We need more guidance in where the CERB and CEWS period stagger.

Are CEWS benefits taxable?

- Yes, it is considered government assistance.

- CEWS also reduced the eligible remuneration eligible for certain tax credits like SR&ED tax credit.

Unanswered questions and ways we think this program can be improved

Computing Revenues

- There are many businesses whose accounting revenues have not declined by at least 30%. Yet, their cash flows are very low because they are not able to collect.

New Businesses in the Dark

- We need more guidance for new businesses that do not have revenues in the prior year.

Timeliness

- 6 weeks to deploy payments might be too late.

CERB vs CEWS

- Depending on their level of wages, if employers do not utilize staff, it may be more beneficial for those employees to claim CERB as opposed to keeping them on the payroll for the 75% subsidy.

- Keep in mind CEWS-subsidized wages will be net of tax while CERB has no withholding tax (although both are taxable when the employee files their tax return in April 2021). In some cases, it may be better to lay off the employee and have them apply for CERB instead. See our blog post on CERB.

Pre-crisis weekly remuneration

- More guidance needed.

- Does it include only recurring periodic payments and excludes performance-based bonuses or commissions?

Online Bandwidth and Data Breach

- Will the government be able to pull this monumental task off, which involves developing an online portal in such a short period to handle large amounts of web traffic and confidential information? How will they protect the system against hackers?

- Businesses will be making rehiring decisions based on the government being able to subsidize wages; therefore, confidence in the system needs to be provided to the public.

[1] $58,700 x 1/52 * 75% = $847.

Read more details on Finance Canada website.