Capital dividends are tax-free dividends corporations can pay to their shareholders. Capital dividends are declared out of the capital dividend account (“CDA”) balance. A corporation can only pay capital dividends to the extent of the CDA balance. The corporation needs to make an election under subsection 83(2) of the Income Tax Act to treat a dividend as a capital dividend for tax purposes.

Many types of transactions increase a private corporation’s CDA balance, but the most common are capital gains and a portion of the life insurance proceeds. For example, when a private corporation has a capital gain, 50% of the capital gain (the non-taxable portion) gets added to the CDA balance. The corporation can then pay out the balance as a tax-free capital dividend. Capital dividends are very beneficial and often used in tax planning as they are tax-free to the recipient.

The Canada Revenue Agency (“CRA”) requires corporations to file Form T2054 when declaring a capital dividend. In addition, the corporation must also attach a certified copy of the dividend resolution and Schedule 89, which details the capital dividend account balance and movement.

The CRA updated the form on September 1st, 2022, without much announcement. The update appears to provide more details to the CRA so that they can better flag potential issues for further scrutiny.

We highlight some of the key changes below.

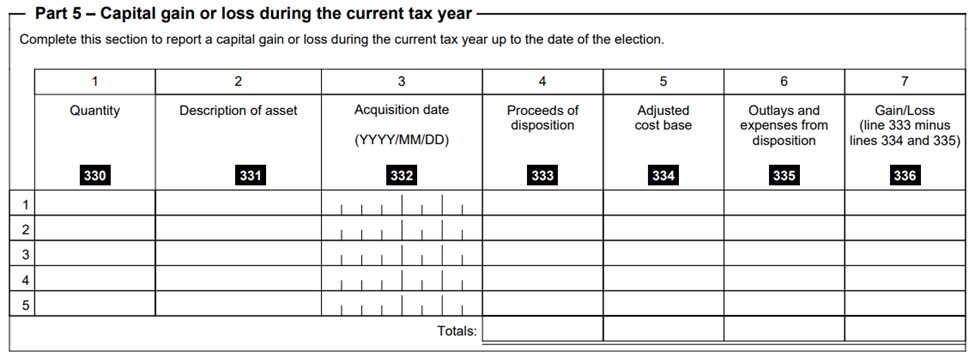

A lot more details of capital gains during the year

You now have to disclose details of capital gains and losses during the year up to the election date. This includes quantity, acquisition date, proceeds, adjusted cost base, and outlays. The CRA didn’t require this information in the past. Disclosing this information could substantially increase the preparation time depending on the number of transactions.

Schedule 89 may not be required

Schedule 89 is only required if the corporation never filed form T2054 before or if the corporation’s CDA balance does not agree with the CRA’s balance. Previously, you needed to submit Schedule 89 for every election.

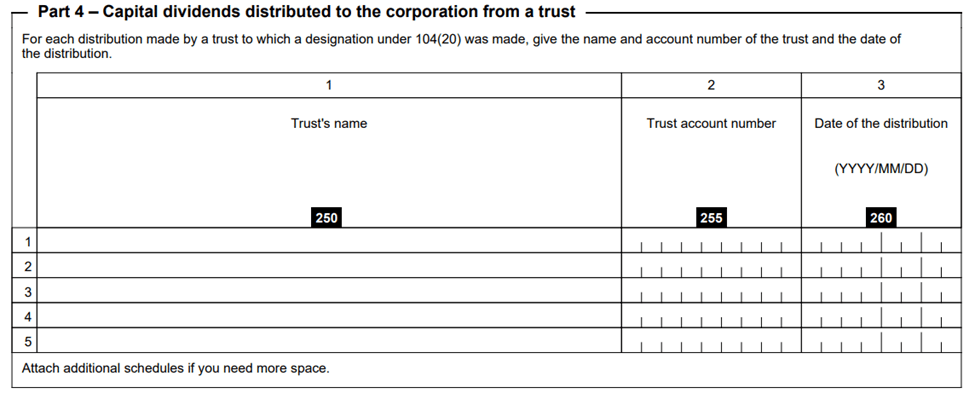

Capital dividends distributed to the corporation from a trust

Previously details on capital dividends distributed from trusts were not required. A trust must designate a capital dividend received from a corporation as part of an amount payable to a beneficiary. This portion of a dividend is then excluded by the beneficiary in computing income. With this new information, the CRA can scrutinize trusts to see if the trust made this designation.

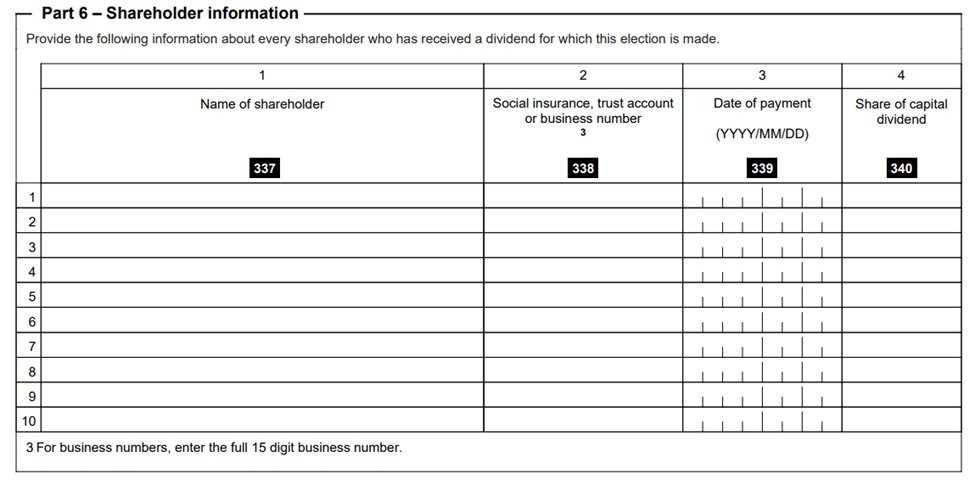

Information about capital dividend recipients

The information of the recipient of the dividend must be disclosed, including the name and SIN or business number.

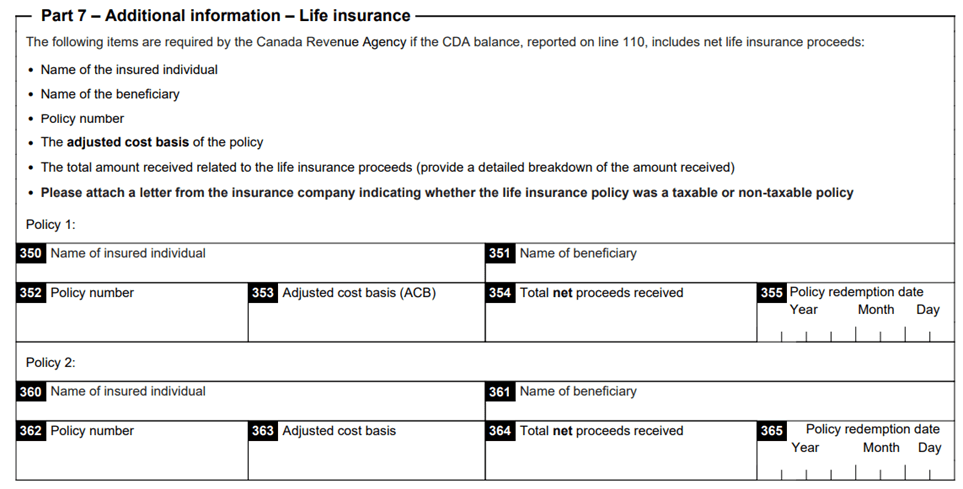

Life insurance details

Previously. If the payor corporation’s CDA balance contains an amount from life insurance proceeds, details of the life insurance policy needed to be disclosed in an attachment, including the amount received, policy number, the ACB etc. This information still needs to be disclosed in the new form. However, there are now box numbers where they will need to be disclosed.

Software Updates

It is unclear whether the CRA will accept the previous version of form T2054. Please note that many of the current tax software have not been updated for this new form. As such, if you are preparing the form, it is recommended that you download the PDF from the CRA’s website and complete it from there. The new form can be found here.