Download PDF Copy

Click here to download a PDF copy of the guide below. The PDF guide also contains a sample T3 Return.

The Canadian government has recently implemented new reporting requirements for trusts[1]. These changes are in accordance with Canada’s international pledge to disclose beneficial ownership information and to maintain the efficiency and honesty of the Canadian tax system. However, the new rules are burdensome and have significant penalties for noncompliance.

Consider the scenario where you co-sign a mortgage for your child on a million-dollar home. This arrangement will likely be using a bare trust arrangement. If you were not aware and did not file tax returns (even though these would be nil returns, with no income), you could be subject to penalties of $50,000 per year plus interest. The current interest rate at the writing of this article is 10% compounded daily.

Unfortunately, these are the rules, and we feel that this new rule unfairly targets average Canadians without access to tax experts. For those Canadians who do have access to a tax specialist, these new rules would mean additional filing costs with little value in return. That is why we prepared a guide. This guide will explain the new rules and provide instructions on how to prepare a simple Nil return yourself for bare trusts with no activity other than legally owning an asset.

Introduction: Trusts may need to file for the first time

Many trusts will be required to file a Trust return for the first time. Before the introduction of the new reporting requirements, a trust that did not earn income, dispose of capital property, or make distributions of income or capital in a year was generally optional to file a trust return.

The change in reporting requirements means that affected trusts will be required to file the following with the Canada Revenue Agency (CRA) every year:

| T3 Trust income tax and information return (T3 return) | The trust tax return contains information about the trust, income, expenses, and taxes owed. |

| Schedule 15 (Beneficial Ownership Information of a Trust) | This is a schedule attached to the trust tax return containing information about the trust’s settlers, trustees, and beneficiaries. |

Chapter 1: Which Trusts need to file a T3 Return?

Generally, all trusts that are required to file a T3 Return, other than:

- graduated rate estates and qualified disability trusts;

- mutual fund trusts, segregated funds and master trusts;

- trusts governed by registered plans (i.e., deferred profit sharing plans, pooled registered pension plans, registered disability savings plans, registered education savings plans, registered pension plans, registered retirement income funds, registered retirement savings plans, registered supplementary unemployment benefit plans and tax-free savings accounts);

- lawyers’ general trust accounts;

- trusts that qualify as non-profit organizations or registered charities; and

- trusts that have existed for less than three months or that hold less than $50,000 in assets throughout the taxation year (provided, in the latter case, that their holdings are confined to deposits, government debt obligations and listed securities).

For an explanation of the above trusts in more detail, please visit CRA’s website by clicking here.

Do Bare Trusts need to file a T3 Return?

Bare trusts are subject to the new trust reporting rules for tax years ending after December 30, 2023[1]. Accordingly, a bare trust is required to file a T3 Return annually unless specific conditions are met. A bare trust is also required to complete Schedule 15 annually. A bare trust with a December 31, 2023 tax year end must file a T3 Return for 2023.

The term “bare trust” is not defined in the Income Tax Act (the “Act”). However, a bare trust for income tax purposes includes a trust arrangement under which the trustee can reasonably be considered to act as an agent for all the beneficiaries under the trust with respect to all dealings with all of the trust’s property.

A bare trust could include a situation where you legally or are named as a legal owner of an asset or property, but the asset is held for the benefit of someone else. Following are some examples of arrangements that may be considered trusts and would be subject to the new reporting rules[2]:

- Joint Ventures: Joint ventures are common in capital-intensive industries with multiple participants developing a project. Joint ventures usually have one participant to act on behalf of other participants (the “operator”) who may have expertise in certain types of developments. The operator typically holds legal title to the development property in trust for the other participants who beneficially own their proportionate interests in the joint venture property. In other words, the joint venture operator would likely be considered a bare trustee and may be required to file an annual T3 trust return. This is the case even though the income/expenses should already be reported by the property’s beneficial owners in their income returns.

- Partnerships: At law, a partnership is not considered a legal entity separate from its partners and generally cannot hold title or a registered interest in its name. As such, the general partner typically holds legal title to land in a bare trust arrangement. The partners’ income is already reported, and beneficial owners (being the partners) are disclosed on the T5013 information return.

- Real Estate: It is common in real estate investments for a nominee corporation to hold the legal title of the property in trust for the beneficial owner for commercial reasons.

- Co-signing a mortgage for a family member: For example, co-signing for a child’s mortgage so that they can qualify for a mortgage to get into the housing market.

- Being named to aging parents’ bank account: It is common to have adult children being named to their aging parents’ bank accounts to make it easier to facilitate transactions.

- Shareholder Registries: Shareholder registries may not always be accurate, as there may be a delay in obtaining up-to-date shareholder information. When dividends are paid, amounts not received by shareholders due to incorrect information are held in trust until they can be corrected. Furthermore, corporations may be required to hold funds from dividends in trust for lengthy periods to the extent that the correct recipient cannot be readily identified.

- Internal Administrative Arrangements: Many internal administrative arrangements may create bare trust relationships. For example, it is common for companies to centralize treasury and banking functions with one entity in a group. Funds may be received or disbursed on behalf of other entities in the group, with funds temporarily held in trust through this process. The tax consequences of the underlying transactions are reported on the tax returns (T2, T5013, etc.) of the relevant entity.

It is crucial to determine the level at which a bare trust arrangement is constituted once it has been identified. For instance, if there are several assets with distinct beneficial ownership in a joint venture, it becomes necessary to establish whether the bare trust exists at the joint venture level or the individual asset level. Another example is when you are named on your parent’s bank and investment accounts, and there are multiple accounts. The question arises of how many trust returns you need to file. Would you file one at the bare trust level or file for each account level, which could mean filing multiple returns? The CRA has yet to give guidance on this matter.

In Trust for Accounts Likely Considered Bare Trusts

Financial accounts held “in trust for” another individual are likely bare trust arrangements. These also have similar concerns that have yet to be answered. For example, suppose a bare trustee holds the legal title of several investments within one account; it is still being determined whether there is only one bare trust at the investment level or multiple bare trusts for each investment.

All Trusts Need to Complete Sch 15

Generally, all trusts that are required to file a T3 Return will be required to file Schedule 15.

Schedule 15 asks for information on all trustees, settlors, beneficiaries and controlling persons (i.e., persons who have the ability, through the terms of the trust or a related agreement, to exert influence over trustee decisions regarding the appointment of income or capital of the trust) for the trust (collectively referred to as “reportable entities“).

For each reportable entity of the trust, the following information must be provided:

- name

- address

- date of birth (if applicable)

- country of residence, and

- Tax Identification Number (i.e., Social Insurance Number, Business Number, Trust Number, or, in the case of a non-resident trust, the identification number assigned by a foreign jurisdiction)

In addition, if the above information cannot be provided because the beneficiary is unknown at the time of filing the T3 Return and Schedule 15 (for example, unborn children and grandchildren, their spouses), information must be provided on Schedule 15 under Part C detailing the terms of the trust that extend the class of beneficiaries to unknown entities.

Chapter 2: Significant Penalties

The penalty will equal $25 for each day of delinquency, with a minimum penalty of $100 and a maximum penalty of $2,500.

If a failure to file the return was made knowingly or due to gross negligence, an additional penalty will apply. The additional penalty will equal 5% of the maximum value of property held during the relevant year by the trust, with a minimum penalty of $2,500. Also, existing penalties for the T3 return will continue to apply.

Relief for Bare Trusts for the 2023 Tax Year

The CRA will relieve bare trusts by waiving the penalty payable under subsection 162(7) for the 2023 tax year in situations where the T3 Return and Schedule 15 are filed after the filing deadline. For the 2023 tax year, where the trust’s tax year ends on December 31, 2023, the filing deadline of March 30, 2024, is extended to April 2, 2024, the first business day after the deadline.

This proactive relief is for bare trusts only and only for the 2023 tax year.

However, a different penalty may apply if the failure to file the T3 Return and Schedule 15 for the 2023 tax year was made knowingly or due to gross negligence. This penalty will be equal to the greater of $2,500 and 5% of the highest amount at any time in the year of the fair market value of all the property held by the trust.

Bare trusts did not have an obligation in years before the 2023 tax year to file a T3 Return, and the CRA recognizes that the 2023 tax year will be the first time bare trusts will be required to file a T3 Return, including the new Schedule 15.

As some bare trusts may be uncertain about the new requirements, the CRA is adopting an education-first approach to compliance and providing proactive relief by waiving the penalty under subsection 162(7) for the 2023 tax year in situations where the T3 Return and Schedule 15 are filed after the filing deadline.

Chapter 3: How to Prepare a Nil Trust Return for Bare Trusts

Case Study

- Green Inc. and Blue Inc. have agreed to work together to develop, manage, and lease a specific piece of land.

- To make this happen, Orange Inc. has been chosen to hold the legal title to the land as the Bare Trustee for Green Inc. and Blue Inc., who are the beneficiaries.

- Orange Inc. has accepted this responsibility and will fulfill its duty as outlined in the agreement dated February 1, 2023. All are residents of Ontario for tax purposes.

- John Doe is the director of all three companies.

Step 1: Register for a Trust Number

You can apply for a trust account number online. You can do this by logging into the CRA online account of the Trustee.

A trustee can apply for a trust account number. You need to know your:

- trust name (see below for guidance on naming conventions for bare trusts)

- contact information

- type of trust.

You must also provide a signed copy of the trust document or agreement.

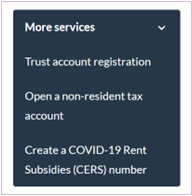

In our case study, Orange Inc. will log into its My Business Account from the “More Services” menu to select Trust account registration.

The questions should be intuitive for simple bare trust arrangements. Please see below for guidance on the naming conventions for a bare trust.

Step 2: Download the PDF Trust Return

You can download a copy of the T3 return and the elated schedules on CRA’s website. Links to the 2023 trust return and schedules are below: T3RET T3 Trust Income Tax and Information Return – Canada.ca

You can find the schedules on the following website: Forms listed by number – CRA – Canada.ca

You can download Schedule 15, the new schedule used to disclose information about the trust and its trustees, settlors, and beneficiaries can be found here: T3SCH15 Beneficial Ownership Information of a Trust – Canada.ca

Step 3: Prepare the T3 Return

Complete the Identification and other information.

Trust account number

Enter the trust account number you obtained online.

Fiscal period

In most cases, it should be January 1, 202X, to December 31, 202X.

Name of Trust

When a bare trust has yet to be named, here are some guidelines CRA provides for naming a bare trust.

| Criteria | Condition |

| If there is a written trust deed or other agreement governing the bare trust and the document identifies a name for it, you can enter it in the name field. | Enter the same in the name field. |

| If there is no written trust deed or other agreement governing the bare trust or if the document does not identify a name for the bare trust | list the legal name of the beneficial owner(s) with the word “Trust” at the end. For example: Corporate Beneficiaries: the full corporate name identified in the articles of incorporation. Individual Beneficiaries: the first and last names of an individual beneficiary. If there is more than one beneficial owner, place the names alphabetically based on the last name with the word “Trust” at the end. |

If there is a written trust deed or other agreement governing the bare trust and the document identifies a name for the bare trust, you can enter it in the name field.

If there is no written trust deed or other agreement governing the bare trust or if the document does not identify a name for the bare trust, list the legal name (e.g., the entire corporate name identified in the articles of incorporation, or the first and last names for an individual) of the beneficial owner(s) with the word “Trust” at the end.

For example, if “Ms. Andrews” is the beneficiary of the bare trust and there is no identified name for the trust, you could list “Ms. Andrews trust” in the name field. If there is more than one beneficial owner, place the names alphabetically based on the last name with the word “Trust” at the end.

When using our online services, the name field is limited to 60 characters; if the name(s) exceed(s) the 60-character limit, you can stop typing when the limit is reached but include the word “trust.”

In our case study, the name of the Bare Trust should be “Blue Inc. Green Inc. Trust.”

Residence of the Trust

Choose the residence of the trustees, including the province. In our case study, it is Ontario.

Trustee Information

Enter the information about the Trustee who is the CRA’s primary contact. If the trustee is a corporation, please enter the corporation’s contact person, such as a director or an officer of the corporation.

Trust Information

Enter information about the trust.

If all your trustees and beneficiaries are Canadian residents, then most likely, the trust will not be a Deemed resident trust.

Type of Trust

Enter the Bare Trust (code 307) for the “type of trust.”

Also, enter the Date that the trust was created.

Information about the return

Enter information about the return.

If this is your first filing ever, which is likely the case for most Bare Trusts in 2023, please select Yes, as noted below.

You must also provide your trust agreement (i.e., trust document) to the CRA when you apply for a trust number. See above for more details. If you did not upload your trust agreement when you opened your trust account numbers, you can upload it later using the following link.

Reporting foreign income and property

Answer the following required questions.

Certification & Signatures

Complete the certification and sign at the bottom of the return. E-signatures are acceptable.

Calculating total income

Since the Bare Trust only holds legal tile, it generally should not have any income. Therefore, you should not need to enter anything in the following sections: “Calculating total income,” “Calculating net income,” “Calculating taxable income,” and “Summary of tax and credits” (steps 2 to 5).

Step 4: Completing Schedule 15

As noted, for tax years ending on or after December 31, 2023, a trust (including a bare trust) required to file a T3 return, other than a listed trust, generally must report beneficial ownership information on Schedule 15.

Trusts must report the identity of all trustees, settlors, beneficiaries, and controlling persons (collectively called “reportable entities”) on Schedule 15. It is necessary to include information for all reportable entities of the trust that existed at any time during the tax year, even if the person became a reportable entity at any time during the tax year or is no longer a reportable entity of the trust at the end of the tax year for which a T3 return is being filed.

Please note that if you are submitting beneficial ownership information for your T3 return, it must be done using Schedule 15. Please be aware that alternative methods such as spreadsheets, PDFs, or XML files will not be accepted. If you are filing the T3 return by paper, Schedule 15 must be used, and in case you need multiple copies of Part B of Schedule 15, you can mail them along with the T3 Return. The fillable PDF version of Schedule 15 includes additional Part B sections if required.

Enter the Year

First, enter the tax year. In our case study, we are working on the 2023 tax year.

Part A – Annual beneficial ownership information

If this is the first time completing Schedule 15, answer as follows:

Part B – Identification of reportable entities and Reportable Entity Type

You will complete Part B for the following:

- Settlors

- Trustees

- Beneficiaries

- Controlling persons

Identifying Settlors

The term “settlor” generally refers to a person who has provided a loan or transferred property, directly or indirectly, to a trust for its benefit. However, exceptions apply, including situations where the person or partnership has engaged in arm’s length transactions with the trust, such as providing a loan at a reasonable interest rate or making a transfer for fair market value consideration.

In our case, the settlors would be Blue Inc. and Green Inc., the parties that transferred the initial funds to purchase the land.

Identifying Trustees

Trustees hold legal title to property in trust for the benefit of the trust beneficiaries. The trustee includes an executor, administrator, assignee, receiver, or liquidator who owns or controls property for some other person.

Identifying Beneficiaries

A “beneficiary” of a trust is generally a person (other than a protector) who has a right to compel the trustee to properly enforce the terms of the trust, regardless of whether that person’s right to any of the income or capital is immediate, future, contingent, absolute or conditional on the exercise of discretion by any person.

The requirement to provide the necessary information in respect of beneficiaries of a trust on Schedule 15 will be met if the required information is provided in respect of each beneficiary of the trust whose identity is known or ascertainable with reasonable effort by the person making the return at the time of filing the return. Suppose a beneficiary’s identity is known or ascertainable; complete Part B of Schedule 15. Suppose a beneficiary’s identity is not known or ascertainable with reasonable effort. In that case, the person making the return must provide sufficiently detailed information to determine with certainty whether any particular person is a beneficiary of the trust. In this case, complete Part C of Schedule 15.

Identifying Controlling Persons

For the trust reporting requirements, the term controlling person means a person who has the ability (through the terms of the trust or a related agreement) to exert influence over trustee decisions regarding the appointment of income or capital of the trust. This would include, for example, a protector of the trust.

See the attached Schedule 15 for guidance on applying it to our case study.

Helpful Sources

| Topic | Link |

| Apply for Trust Account Number | How to apply: Application for a Trust Account Number – Canada.ca |

| CRA’s T3 Trust Guide 2023 | T4013 T3 Trust Guide 2023 – Canada.ca |

| T3 Trust Income Tax and Information Return (Fillable PDF) | T3RET T3 Trust Income Tax and Information Return – Canada.ca |

| Schedule 15: Beneficial Ownership Information of a Trust (Fillable PDF) | T3SCH15 Beneficial Ownership Information of a Trust – Canada.ca |

| CRA’s Guide on New trust reporting requirements for T3 returns filed for tax years ending after December 30, 2023 | New trust reporting requirements for T3 returns filed for tax years ending after December 30, 2023 – Canada.ca |

[1] Subsection 150(1.3) of the Income Tax Act (the “Act”).

[2] Tax Executives Institute (TEI) Commentary, 2023-09-27 — Bare Trust Reporting Rules – 2023-09-27