Latest Posts

CRA Clarifies Tax Deadlines for Taxpayers Affected by Capital Gains

The CRA has delayed the capital gains inclusion rate increase to January 1, 2026, requiring tax form revisions and causing filing delays. Relief from late penalties and interest is granted until June 2, 2025, for impacted T1 filers and May 1, 2025, for T3 slips. T5008 deadlines extend to March 17, 2025.

Have Foreign Bank Accounts? CRA Can Reassess You for Years – And It Could Cost You Big

If you have foreign bank accounts, beware: CRA can reassess you for years and impose hefty penalties. In the case of Azmayesh-Fard v. The King, a taxpayer faced massive fines for not reporting a Swiss account. Protect yourself by reporting all foreign assets to avoid financial nightmares.

Navigating the Capital Gains Tax Changes Amid Parliamentary Uncertainty

This article discusses the federal government’s proposed capital gains inclusion rate increase, the impact of Parliament’s prorogation on its implementation, the CRA’s interim approach, and the potential implications for taxpayers. It also explores political party stances, taxpayer options, and possible administrative relief measures.

Canada’s Proposed Tax on Vacant Land: Is It the Right Approach?

Canada’s proposed tax on vacant land aims to tackle the housing crisis, but could it backfire? While the intention is commendable, experts warn that such measures may distort economic behavior and burden smaller developers. Instead of penalizing real estate developers, a more effective solution might be to offer tax incentives that encourage immediate construction. Drawing lessons from Ireland’s experience with similar policies, this article explores the potential pitfalls of a vacant land tax and advocates for a collaborative approach that benefits both the government and developers. Discover why tax breaks could be the key to solving Canada’s housing shortage.

Subscribe to our newsletter

Don't miss new updates on your email

All Blog Posts

CRA Targets “Incorporated Employees” in Latest Campaign

The CRA is escalating its scrutiny of personal services businesses towards the end of 2022. CRA typically undertakes campaigns where they focus on a specific issue and cast a large net to identify taxpayers who may be in violation of certain tax rules.

CRA to Require Electronic Payments for Amounts over $10,000 starting in 2024

The government released draft legislation under new subsection 160.5(2), which requires making payments and remittances to the CRA through electronic means where the amount of the remittance or payment exceeds $10,000. There is an exception if the payor or remitter cannot reasonably remit or pay the amount electronically. It is unclear what the threshold for

Latest Tax Court Ruling on Why Preparing Financial Statements is Important to Receive Tax Benefits

A recent court ruling demonstrates why preparing financial statements is important if you are receiving tax benefits and credits.

The Capital Dividend Election Just Got More Complicated

The CRA made changes to the capital dividend election form (T2054). We highlight some of the changes in this article.

The Government of Canada’s Affordability Plan and What It Means for You

On June 16, 2022, Deputy Prime Minister Crystia Freeland announced an “Affordability Plan” to tackle the ongoing price increases in the economy. These measures are meant to help Canadians weather the recent price increases for goods and services.

Underused Housing Tax & Traps That Could Result in Huge Penalties

If you own residential property, you should be aware of the newly proposed Underused Housing Tax (“UHT”) set to take effect on January 1, 2022. The UHT is a national, annual 1% tax on the value of non-resident, non-Canadian-owned residential real estate that is vacant or underused.

Budget 2022: Measures Affecting Individuals &Small Business Owners

On April 7, 2022, Finance Minister, Chrystia Freeland tabled the federal budget. We highlight some of the newly announced tax measures that affect individuals and small business owners.

The New Luxury Tax: Draft Legislation Released

On March 11, 2022, the government released a 173-page draft legislation for the up-and-coming luxury tax on vehicles, aircraft, and vessels. In other words, these rules are meant to tax you if you purchase luxury cars, airplanes, helicopters, boats, yachts over a certain price.

New CRA Disclosure Rules: CRA Proposes to Target Common Private Company Aggressive Tax Planning

The Department of Finance is proposing new disclosure rules that allow CRA to better target owner-manager aggressive tax planning.

New Rule Proposal: Postdoctoral Fellowship Incom Can Now Generate RRSP Room

The government announced good news for taxpayers who earned fellowship income all the way back from 2011 to increase their RRSP room.

Government Extends CEBA Loan to End of 2023

Good News! The government has just announced an extension for the repayment of CEBA to December 31, 2023! This means that you can repay CEBA on or before December 31, 2023, and qualify for loan forgiveness of up to $20,000. CEBA provided interest-free loans of up to $60,000 to small businesses to help cover their

You May be able to Deduct More Vehicle Expenses in 2022

For the 2022 year, you may be able to deduct more vehicle expenses in your business. This is not because the government wants to encourage businesses to invest in vehicles. Instead, it reflects recent increases in the Consumer Price Index (CPI). Inflation is driving up these increases, and the tax rules are allowing you to

Everything You Need to Know about the Tourism and Hospitality Recovery Program (Updated December 22, 2021)

What is it? In a nutshell, the Canadian federal government plan to continue the wage and rent subsidies for the tourism and hospitality industry with updated subsidy rates Who qualifies? The subsidy would be available only to organizations in selected sectors of the tourism and hospitality industry. The subsidy helps businesses deeply affected by the

Parliament Returns Today, What Tax Changes Can We Expect?

Today, the House of Commons reconvenes after nearly five months. Normally, there would’ve been a fall economic update. Last year, Finance Minister Chrystia Freeland released the fall economic statement on November 30th. We do not yet know when Minister Freeland will release this year’s fall economic statement. Still, with many campaign promises to implement, we

CRA Releases TFSA and Other Limits for 2022

Each year, certain personal income tax and benefit amounts are indexed to inflation using the Consumer Price Index (CPI) data as reported by Statistics Canada. Because of the higher inflation this year, some amounts indexed to inflation are a lot higher. Here are some of the highlights for 2022: 2022 2021 Basic personal amount

Your Cryptocurrency May Be Foreign Property, and Failure to File Form T1135 Could Result in Severe Penalties

Canadian resident individuals, corporations, and certain trusts have to file a unique form called Form T1135 if, at any time during the year, they owned foreign property costing more than $100,000. There are significant penalties for failure to file Form T1135 or for making a false statement or omission. The maximum penalty could be anywhere

Changes to the Canada Recovery Hiring Program

To help businesses emerge out of the pandemic, the government introduced the new Canada Recovery Hiring Program (CRHP) to provide businesses with a subsidy of up to 50% on the incremental remuneration paid to eligible employees between June 6, 2021 and November 20, 2021. The subsidy was determined by the following formula: A x (B-C)

Everything You Need to Know About the Hardest-Hit Business Recovery Program

What is it? In a nutshell, the Canadian federal government plan to continue the wage and rent subsidies for hard-hit businesses that do not qualify for the Tourism and Hospitality Recovery Program and that have been deeply affected by the pandemic. This generally means a prolonged revenue decline of at least 50%. Who qualifies? All

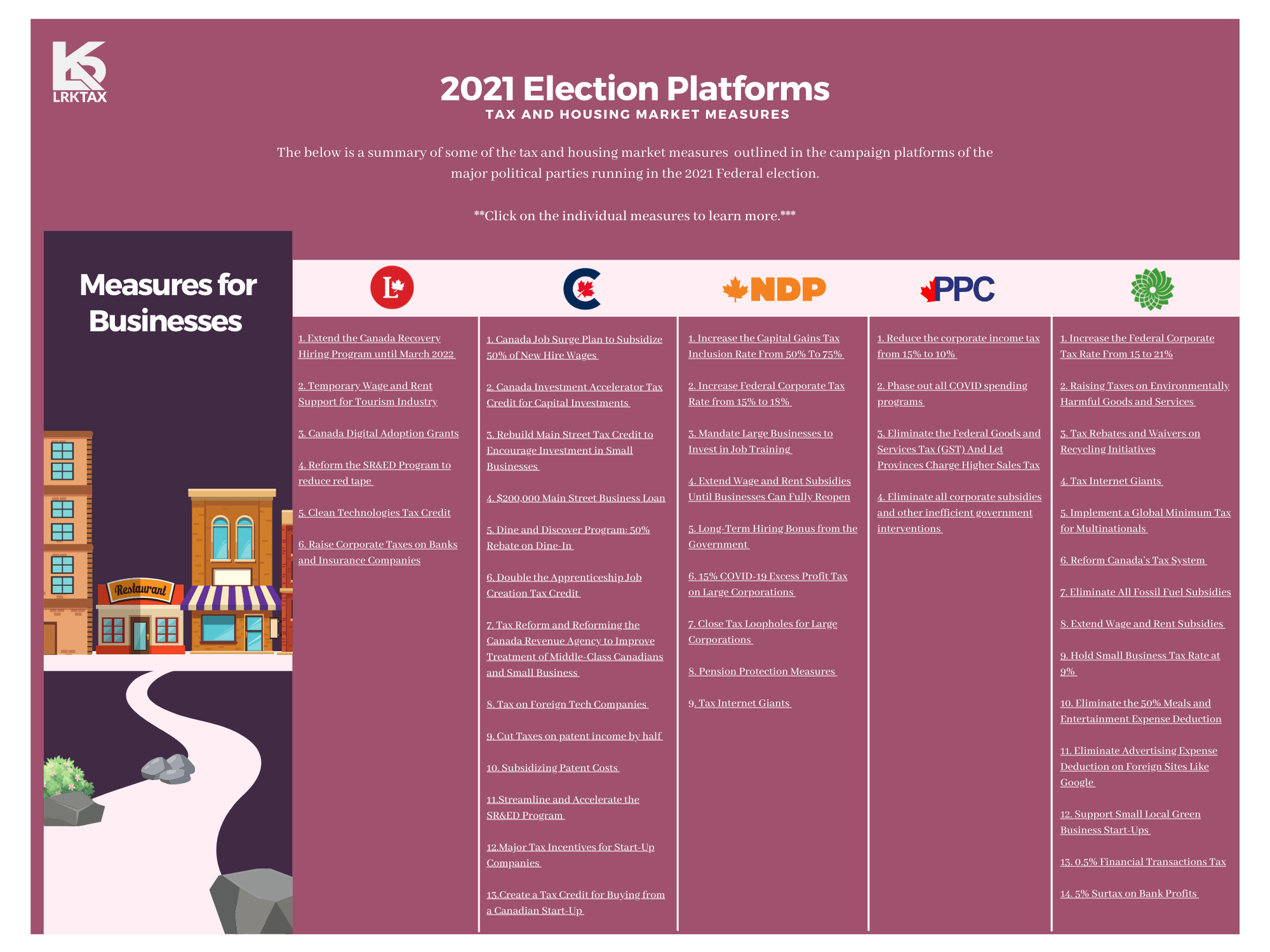

2021 Election Platforms: Tax and Housing Measures Promises

The federal election is only a few days away. The below is a summary of all the tax and housing market promises by Canada’s major political parties. Click the below image for more details.

Liberals: 2021 Election Tax & Real Estate Measures

The below highlights some of the tax measures proposed by the Liberal Party of Canada for the 2021 Canadian federal election that will be held on September 20, 2021. The purpose of the below article is to summarize and outline the different tax measures published by the political parties in their election platforms in an impartial manner.

The NDP: 2021 Election Tax and Real Estate Measures

The below highlights some of the tax measures proposed by the New Democratic Party of Canada for the 2021 Canadian federal election that will be held on September 20, 2021. The purpose of the below article is to summarize and outline the different tax measures published by the political parties in their election platforms in an impartial

People’s Party of Canada: 2021 Election Tax & Real Estate Measures

The below highlights some of the tax measures proposed by the People’s Party of Canada for the 2021 Canadian federal election that will be held on September 20, 2021. The purpose of the below article is to summarize and outline the different tax measures published by the political parties in their election platforms in an impartial manner.

Green Party of Canada: 2021 Election Tax & Real Estate Measures

The below highlights some of the tax measures proposed by the Green Party of Canada for the 2021 Canadian federal election that will be held on September 20, 2021. The purpose of the below article is to summarize and outline the different tax measures published by the political parties in their election platforms in an impartial manner.

Conservatives: 2021 Election Tax & Real Estate Measures

The below highlights some of the tax measures proposed by the Conservative Party of Canada for the 2021 Canadian federal election that will be held on September 20, 2021. The purpose of the below article is to summarize and outline the different tax measures published by the political parties in their election platforms in an

Liberals Kill Bill C-208 and Brought It Back to Life (Temporarily)

Imagine yourself as an owner of Stephanie’s Electric, a company specializing in electrician services. Stephanie’s Electric started off small but is now an established company in the community. From the beginning, you taught your children the ways of Stephanie’s Electric, and they have managed to become really good at it. You’re now ready for retirement and to pass the business along to them. However, you weigh your options and realize you will pay less