The Canadian Government has proposed legislation to establish the Canada Emergency Response Benefit (CERB). This taxable benefit would provide $2,000 a month for up to four months for workers who lose their income due to COVID-19 for at least 14 consecutive days within any four-week period from March 15, 2020 until October 3, 2020.

You may apply for any four-week period falling within the period beginning on March 15, 2020 and ending on October 3, 2020. According to the draft legislation, the last day to apply is December 2, 2020.

The CERB is supposed to be a simpler and more accessible than the previously announced Emergency Care Benefit and Emergency Support Benefit.

The CERB would cover Canadians who have lost their job, are sick, quarantined, or taking care of someone who is sick with COVID-19, as well as working parents who must stay home without pay to care for children who are sick or at home because of school and daycare closures.

The CERB would apply to wage earners, as well as contract workers and self-employed individuals who would not otherwise be eligible for Employment Insurance (EI). Alternatively, individuals eligible for EI can apply for the CERB instead of EI if the CERB benefit will be more.

Do employees need to be laid off?

Workers who are still employed but are not receiving income because of disruptions to their work situation due to COVID-19, would also qualify for the CERB. In other words, their work must cease due to COVID-19, but they could still be employed.

This would help businesses keep their employees as they navigate these challenging times while ensuring they preserve the ability to quickly resume operations as soon as it becomes possible.

Who is eligible?

Canadian workers, whether through an employer or self-employed, over the age of 15 who have earned more than $5,000 from:

- employment,

- self-employment,

- certain other benefits/income, or

- non-eligible dividends **note this was a late addition on CRA’s website**

in the last 12 months but are now earning no income because of the COVID-19 pandemic would qualify.

A worker is eligible for an income support payment only if the following two conditions are met:

(a) the worker ceases working for reasons related to COVID-19 for at least 14 consecutive days within the four-week period in respect of which they apply for the payment; and

(b) the worker does not receive, during these 14 days, income from:

- employment,

- self-employment,

- Employment Insurance benefits,

- allowances, money or other benefits paid to them under a provincial plan because of pregnancy or in respect of the care by the worker of their new-born children or children placed with them for the purpose of adoption.

- (presumably this includes non-eligible dividends as well due to CRA’s late addition to the rules)

**On April 6th, CRA clarified that for subsequent benefit periods (i.e., after the March 15th to April 10th initial 4-week period), they expect to have no employment or self-employment income.

Can I quit my job and apply?

No. According to the draft legislation, an employed worker cannot quit their employment voluntarily and be eligible for the CERB.

Can I apply if I am already getting EI regular and sickness benefits?

No. Canadians who are already receiving EI regular and sickness benefits as of today would continue to receive their benefits and should not apply to the CERB.

If their EI benefits end before October 3, 2020, they could apply for the CERB once their EI benefits cease, if they are unable to return to work due to COVID-19, provided they meet the other conditions above.

Canadians who are eligible for EI regular and sickness benefits would still be able to access their normal EI benefits, if still unemployed, after the 16-week period covered by the CERB.

When Can I apply?

The portal for accessing the CERB would be available on April 6th . EI eligible Canadians who have lost their job can continue to apply for EI here, as can Canadians applying for other EI benefits.

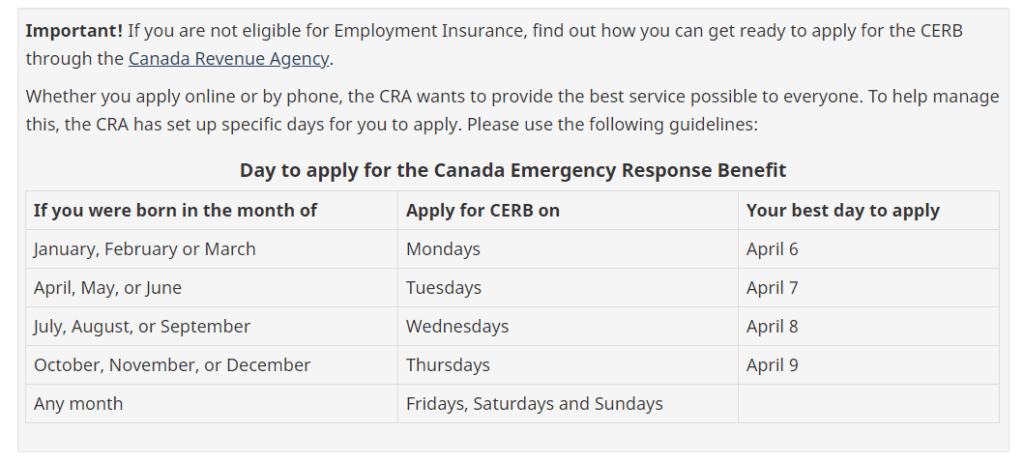

The days that you can apply is based on your birth month to avoid bandwidth overload.

How soon will the Benefits be Deployed?

Within 10 days of application. The CERB would be paid every four weeks and be available from March 15, 2020 until October 3, 2020. If you apply for the CERB in early April when the application first opens, your first payment would be 10 days following your date of application.