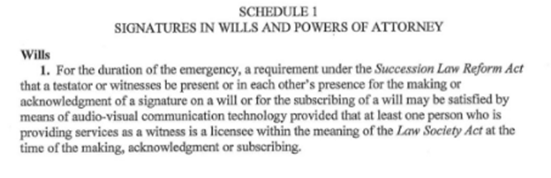

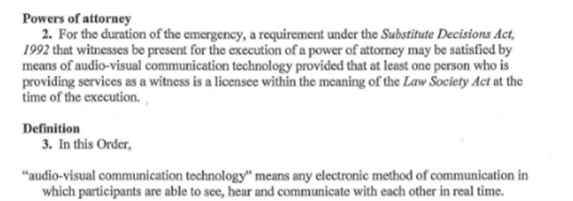

With more and more people thinking about updating their wills or getting their power of attorney (POA) done during the COVID-19 pandemic, the Ontario government has relaxed rules surrounding the need to witness such documents. Under the existing rules, a will is only valid when the testator makes or acknowledges the signature in the presence of two or more attesting witnesses present at the same time. With physical distancing measures in place, this is no longer possible.

According to portions of the new regulations tweeted by Ontario’s Attorney General, the requirement to witness a will can be satisfied by audio-visual communication technology (i.e., video chat applications such as Skype, Zoom, Cisco WebEx, Teams, etc.). This is a good gesture by the Ontario government and will put many Ontarians looking to get their affairs in order at ease.

Here are snippets of the legislation. The entire legislation should be available sometime today.