In this article, we explain how the recent changes in capital gains rates will impact small businesses in Canada. They will affect not only how much they pay in taxes on capital gains but also their regular business income.

The Small Business Deduction Eroded Faster Under New Rules

The small business deduction (SBD) in Canada offers significant tax relief to small businesses and entrepreneurs operating through Canadian-controlled private corporations (CCPCs). This deduction allows CCPCs to benefit from a lower corporate income tax rate on up to $500,000 of active business income annually, known as the corporation’s “business limit.”

In Ontario, eligible CCPCs benefit from a reduced tax rate of 12.2% under the SBD. However, the business limit is reduced on a straight-line basis when the “adjusted aggregate investment income” (i.e., passive income like rent, dividends, interest, and taxable capital gains) of the CCPC and its associated corporations falls between $50,000 and $150,000. We illustrate this with an example below.

Example: How the New Capital Gains Rate Also Increases Taxes on Business Income

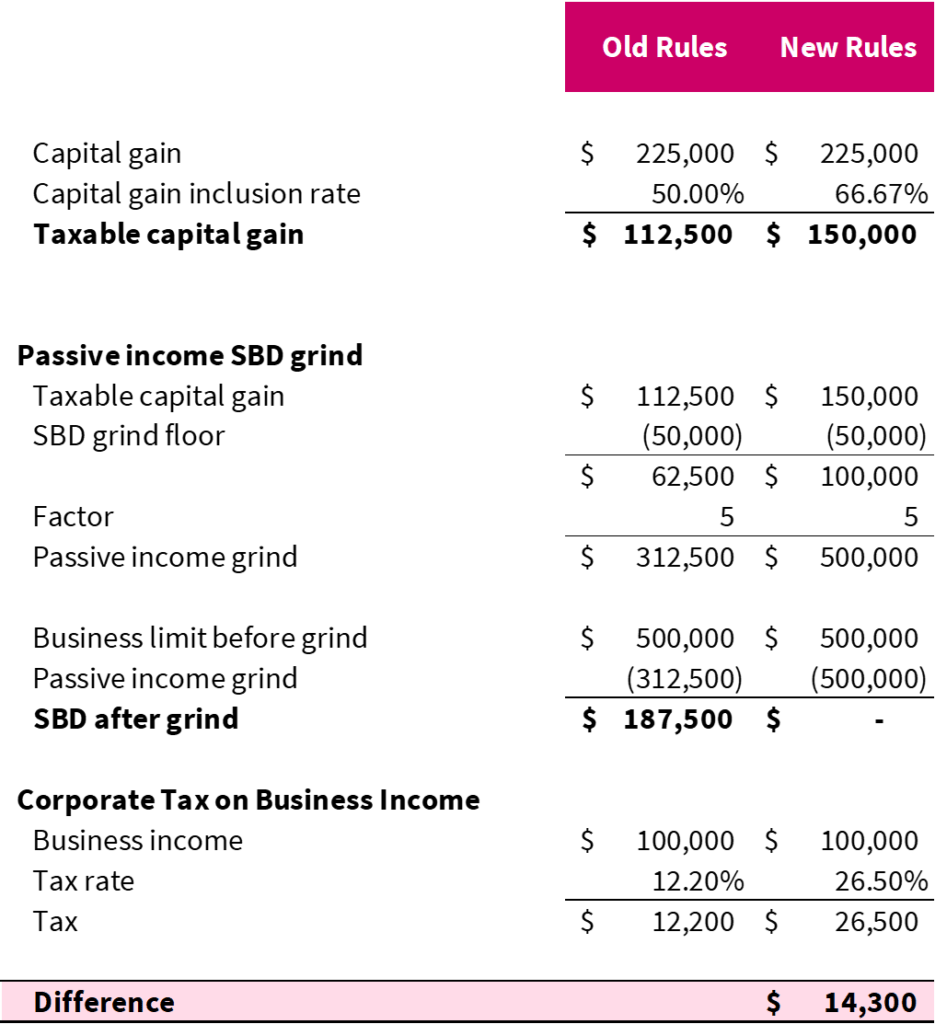

Consider ACo, with a fiscal year from January 1 to December 31. Suppose ACo realizes a $225,000 capital gain in 2024 under the new capital gains inclusion rate, alongside $100,000 in regular business income in 2025.

Under the previous inclusion rate of 50%, ACo’s taxable capital gain would be $112,500. With the new inclusion rate of 66.67%, the taxable capital gain increases to $150,000.

This increase in taxable capital gain causes the tax on regular business income to also increase as follows:

- Under old rules, a $112,500 taxable capital gain would reduce the business limit by $312,500, resulting in an SBD after the grind of $187,500.

- Under new rules, a $150,000 taxable capital gain leads to a larger passive income grind of $500,000, effectively eliminating the SBD.

- Consequently, ACo faces a higher corporate tax rate on its business income, increasing from 12.2% to 26.5%, resulting in an additional tax burden of $14,300.

Under the old rules, assuming no other passive income, a corporation could realize between $100,000 and $300,000 in taxable capital gains without fully eroding the SBD. With the new inclusion rate, this range narrows to $75,000 to $225,000.

The Capital Gains Inclusion Hurts Small Business Owners and Entrepreneurs

Many small business owners and entrepreneurs, who often lack benefits like medical coverage and pensions, take risks to stimulate the economy by creating jobs, goods, and services. The lower business tax rate helps these entrepreneurs save for the future to offset risks. These business owners also have capital gains from selling off investments or rebalancing portfolios. Although the government asserts that the increased inclusion rate is fair and does not harm small business owners, this example illustrates the contrary.

A potential strategy for CCPCs might be to defer realizing capital gains in the hope that the inclusion rate might revert to the historical 50%. The capital gains tax in Canada, introduced in 1972 under Prime Minister Pierre Trudeau, initially included 50% of capital gains in taxable income. This rate was increased to 66.67% in 1988 and then to 75% in 1990 by the Progressive Conservative government to address budget deficits. Later, the Liberal government reduced the rate back to 66.67% in 2000 and then to 50% in 2001 to stimulate investment and economic growth. The 50% inclusion rate has been the most common, reflecting a balanced approach to encouraging investments.

Effective Tax Planning for Small Businesses

In conclusion, recent changes in capital gains inclusion rates emphasize the need for strategic tax planning to preserve small business wealth. As tax specialists, we are committed to helping small business owners and entrepreneurs navigate these challenges effectively. Our tailored strategies are designed to grow your wealth tax-efficiently amidst these new rules. Contact us today to explore how our expertise can support your business.

Take the first step toward success!

Ready to protect your income? Contact LRK Tax for expert strategies and book your free consultation now!