As of June 25, 2024, capital gains in Canada are included in income at a 2/3 inclusion rate, up from the previous 1/2 rate. This increases the tax for large gains on investments. However, there’s good news: the first $250,000 of capital gains still benefits from the 1/2 inclusion rate, providing substantial tax savings.

For those in the top tax bracket, qualifying for this $250,000 capital gains allowance can save $22,000 in taxes. Many taxpayers are now looking for ways to multiply this benefit—especially by using spousal transfers.

How to Multiply the $250,000 Capital Gains Allowance with Your Spouse

One strategy to multiply the capital gains allowance is to split capital gains with a spouse, without triggering the attribution rules, which prevent income splitting. By following the correct steps, each spouse can claim the $250,000 allowance and reduce the overall tax liability.

Example: Andrew and Jane

Andrew and Jane are married, and Andrew owns a stock worth $100,000, which he bought for the same amount. He predicts the stock’s value will grow to $600,000 in one year. To maximize the capital gains allowance, Andrew takes the following steps:

- Sell Half the Stock to Jane at Fair Market Value – Andrew sells half of his stock to Jane for $50,000, which is the fair market value. This avoids triggering attribution rules.

- Elect Out of the Spousal Rollover – Normally, when you transfer assets to your spouse, a spousal rollover defers the tax on any unrealized capital gains. However, in this case, Andrew elects out of the rollover to ensure that Jane’s future capital gains and investment income are not attributed back to him. Jane issues Andrew a promissory note for $50,000 with an interest rate set at the CRA’s prescribed rate (currently 5%, though this rate may change as interest rates fluctuate).

- Cost Basis Adjustment – Both now hold half of the stock with a cost basis of $50,000 each.

- Stock Appreciates to $600,000 –After a year, the stock grows to $600,000, and both sell the stock, resulting in a $500,000 capital gain. Andrew and Jane each realize a $250,000 gain ($300,000 – $50,000).

- Interest on the Loan –Jane pays Andrew $2,500 in interest (5% of $50,000), ensuring the attribution rules won’t apply.

- Capital Gain Reporting

- Andrew reports $250,000 in capital gains and $2,500 in interest income.

- Jane reports $250,000 in capital gains and deducts the $2,500 interest as an expense.

Tax Savings Breakdown

- Total Capital Gains: $500,000

- Andrew’s Tax: Andrew reports $250,000 at the 1/2 inclusion rate, resulting in a taxable gain of $125,000.

- Jane’s Tax: Jane also reports $125,000 in taxable gains.

- Interest Treatment: Jane’s $2,500 interest payment reduces her taxable income while Andrew adds it to his.

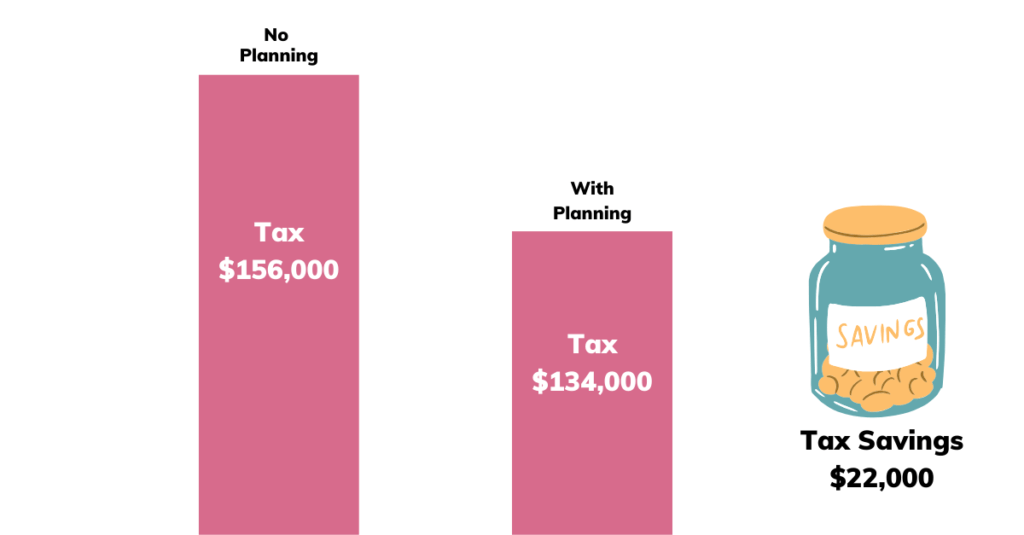

If Andrew had reported the full $500,000 gain by himself, his tax bill would have been $156,000. By splitting the gains, their combined tax liability is $134,000, saving $22,000.

How This Strategy Works

This strategy doubles the capital gains allowance for married couples. Transferring assets at fair market value ensures the attribution rules don’t apply, allowing both spouses to claim the $250,000 capital gains allowance.

Final Thoughts

With the capital gains inclusion rate rising to 2/3 after June 25, 2024, taking advantage of the $250,000 allowance at the 1/2 inclusion rate is a valuable strategy for high-income taxpayers. Spousal transfers, like Andrew and Jane’s, can result in significant tax savings. However, with complex tax rules and potential scrutiny under the General Anti-Avoidance Rule (GAAR), careful planning is essential. Also note that the capital gains legislation is still in draft.

At LRK Tax LLP, our team can help you navigate these rules and maximize your tax benefits. Contact us today to learn how we can tailor your capital gains strategy.