How to prepare the UHT Return

How to prepare the UHT Return – This guide aims to help owners of residential real Property in Canada complete the “UHT-2900 – Underused Housing Tax Return and Election Form” for the most encountered situations. For more unique situations, please feel free to contact us. How to prepare UHT Return.

Please note that for brevity, we may refer to the application of the rules to an individual’s “spouse”; however, the rules also encompass common-law partners.

Download our PDF Guide

To download a PDF copy of the guide, please complete the form below, and we will email you a copy.

What is the Underused Housing Tax (UHT)?

The Underused Housing Tax (“UHT”) is a national, annual 1% on the value of non-resident, non-Canadian-owned residential real estate that is underused. It came into effect on January 1, 2022.

Although the tax is meant to apply to non-residents and non-Canadians, some Canadians – such as Canadian private corporations owning residential properties – may still need to file a tax return, even though they may not have any taxes to pay. We go over this in more detail below.

Step 1: Do You Need to File the Underused Housing Tax Return?

A person who is an “owner” (other than an “excluded owner”) of one or more “residential properties” on December 31 of a calendar year must file a separate tax return for each residential property for the calendar year.

Who is the “owner”?

An “owner” of a residential property is generally the legal owner of the Property (i.e., the person registered on title).

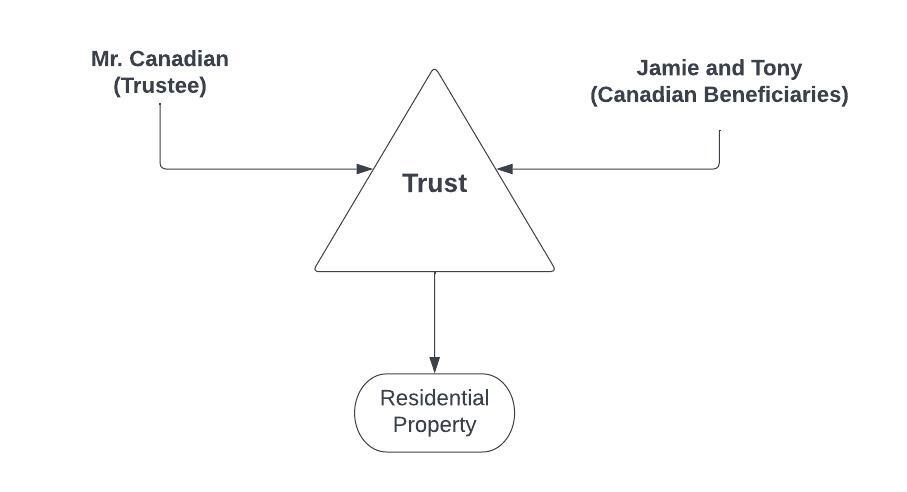

Special Rules for Trustees and Partners of Trusts and Partnerships

Note that you may have to file an Underused Housing Tax Return as a trustee or a partner of a partnership. Unlike the income tax rules, the trustee or the partners must file the Underused Housing Tax Return.

If the Property is owned through a Trust or a Partnership, the legal owners would generally be the trustees or partners. The land registration system should list the trustees and partners as the legal owners, not the trust or the partnership. Unlike corporations, trusts and partnerships are not separate legal persons. This means the trustees and partners would file the tax return and pay the tax. Therefore, the trustees and partners must file the Underused Housing Tax Return for each real property owned through a trust or partnership.

If there are taxes, the trust or Partnership will likely need to reimburse the trustees or partners so they can pay the tax. Note how the UHT slightly differs from income tax, where a Trust is considered a taxpayer and files a tax return (T3 Return).

Excluded Owner

Excluded owners do not have to pay the Underused Housing Tax or file a tax return. An excluded owner includes a person that is on December 31 of the calendar year:

- An individual that is a Canadian citizen or a permanent resident of Canada, except where the individual holds an interest in Property:

- as a partner of a partnership, or

- as a trustee of a trust, but not as personal representative of a deceased individual or the estate of a deceased individual;

- a corporation incorporated under the laws of Canada or a province whose shares are listed on a Canadian stock exchange designated for Canadian income tax purposes;

- a registered charity for Canadian income tax purposes;

The list above is not exhaustive. There are other excluded owners, so please refer to the CRA guide for a complete list.

Due Date for Underused Housing Tax

You must file and pay the Underused Housing Tax on or before April 30 of the following calendar year. For example, the Underused Housing Tax for the 2022 calendar year is due by April 30, 2023.

Residential Property

You are liable for the Underused Housing Tax only if you own “Residential Property.” Generally, for purposes of UHT, Residential Property is a property situated in Canada that is either of the following:

- a detached house or similar building that contains not more than three dwelling units, along with any appurtenances and the related land

- a semi-detached house, rowhouse unit, residential condominium unit, or other similar premises, along with any common areas or appurtenances and the related land

Related land refers to the land that is subjacent or immediately contiguous to a residential building, and that is reasonably necessary for its use and enjoyment as a place of residence for individuals. Generally, up to a half hectare of subjacent land immediately contiguous to a residential building is considered reasonably necessary for the building’s use and enjoyment as a place of residence for individuals.

Common Residential Properties include detached homes, duplexes, triplexes, semi-detached homes, townhomes, rowhouses, and residential condo units.

Who is an Affected Owner?

Unless you are an “excluded owner,” you must file the Underused Housing Tax Return (Form UHT-2900) if you owned residential real estate on December 31 of the calendar year. CRA refers to these owners as “Affected Owners.”

All “Affected Owners” must file the Underused Housing Tax Return even if they are exempt from paying tax.

Be careful: Canadians and Canadian Corporations can be Affected Owners

Although most Canadian owners of residential Property are excluded owners, there are situations where some Canadian owners of residential Property are Affected Owners and, therefore, have to file a UHT Return. For example, a private corporation incorporated in Canada that owns residential Property will have to file a UHT Return even if all of its owners are Canadians. As we explain below, this corporation may not have to pay any UHT Tax, but still needs to file a UHT return to declare an exemption.

Step 2: Download the UHT Tax Return

If you are an Affected Owner in step 1, you must file an Underused Housing Tax Return (Form UHT 2900). You can download a fillable version of Form UHT 2900 here.

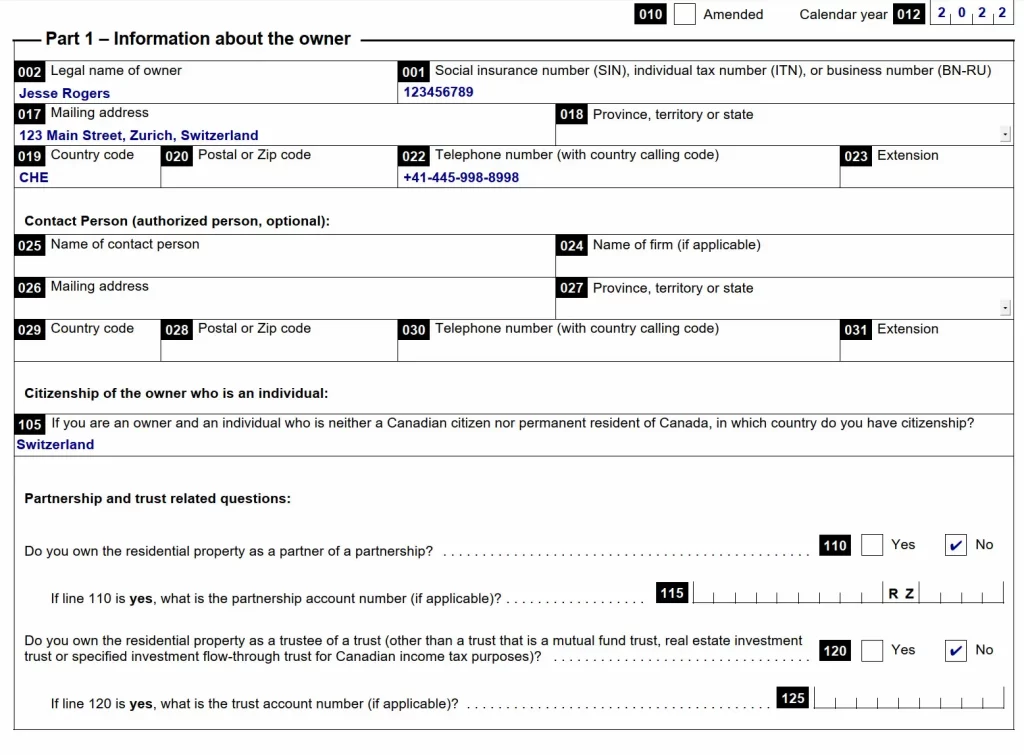

Step 3: Part 1 – Information about the owner

Example

We will complete the UHT return on a step-by-step basis using the following example:

- Jesse Rogers is a resident and citizen of Switzerland and owns real estate in Canada.

- He owns a detached house in Canada as the sole owner per the land registration documents.

- He purchased the home for $1 million in 2020, the property’s most recent sale price. The most recent value on the property assessment notice is $500,000.

- Jesse noted that the property had decreased in value recently, so he obtains a third-party appraisal of $800,000 on January 5, 2023.

Taxation Year

The UHT applies for a calendar year (January to December), so make sure to enter the calendar year on the top. In our example, it is 2022.

Owner

In this section, you complete information about the owner. As mentioned above, the owner of a residential property is generally the legal owner of the Property (i.e., the person registered on the title).

Tax Number

The owner should register for a tax number by calling the CRA at 1-800-959-8281 if they do not already have a Canadian SIN, Business Number, or Individual Tax Number.

Country Code

You can obtain the country code by clicking here. Please enter the three-letter code.

CRA Authorized Representative

You can provide details of your authorized CRA representative if you want CRA to reach out to them with any questions. If your accountant helped you prepare the UHT form, you could include their contact details.

Partnerships and Trusts

Suppose you own residential property as a trustee of a trust or a partner of a partnership. In that case, you will complete lines 110, 115, 120, and 125 accordingly.

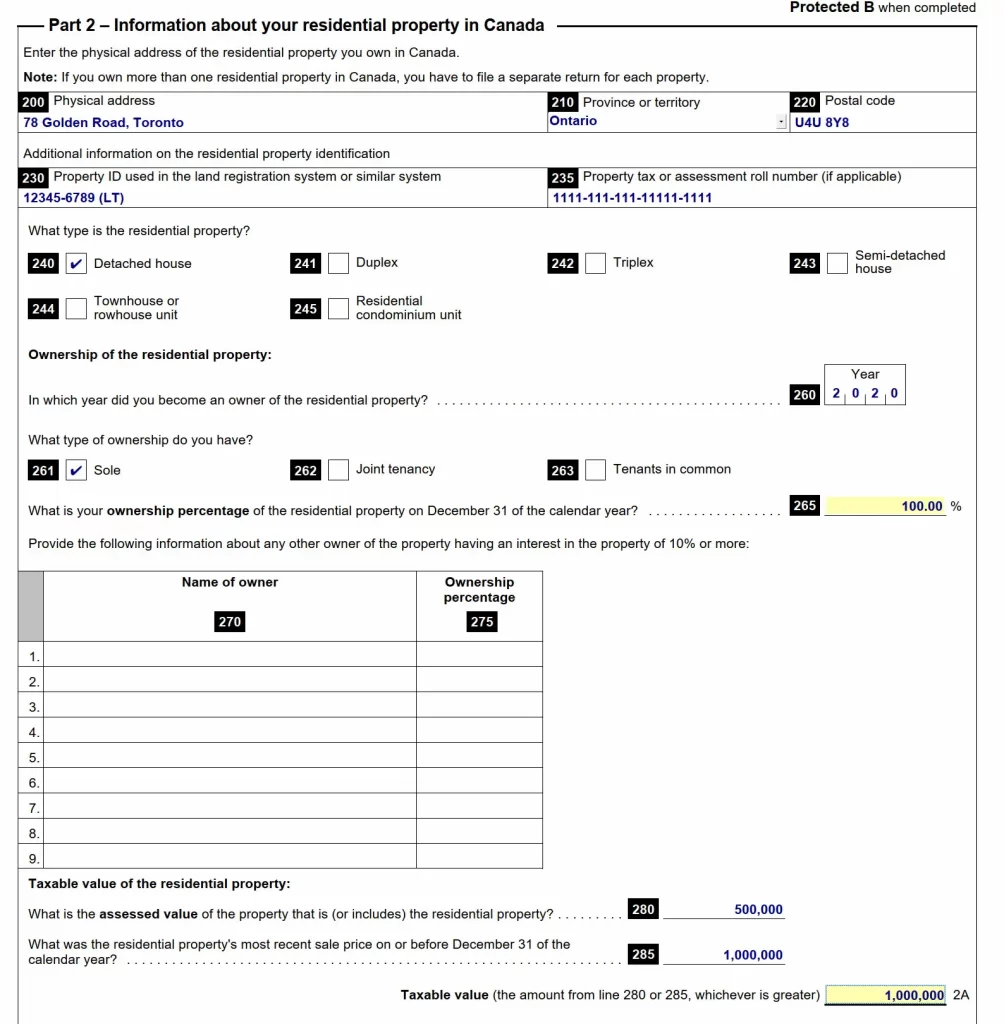

Step 4: Part 2 – Information about your residential property in Canada

Property Address

Enter the residential property’s address. Note if you have multiple properties, you need to file a separate form for each property.

Property Identification Number (Property ID or PIN)

You must enter the Property Identification Number (Property ID or PIN). For example, in Ontario, each has been assigned a unique 9-digit electronic identifier, known as a “Property Identification Number” or “PIN” for short. It serves as a numerical index when identifying the property through its legal description.

Depending on your province or municipality, you may be able to find the Property Identification Number (PIN) by checking the following sources:

- Property assessment notice: The PIN may also be included on the annual property assessment notice.

- Property tax bill: The PIN may be included on the property tax bill.

- Municipal property records: If you have access to the municipal property records, you can find the PIN there.

- Legal documents: Search your legal documents to see if you can find the PIN there.

- Online property search tools: Some municipalities provide online property search tools that allow you to search for property information by address or PIN.

Contact your local municipal government office or the land registry office for assistance if you cannot find the PIN.

Property tax or assessment roll number

In Ontario, the assessment roll number can typically be found on your property assessment notice, which is sent to you annually by the Municipal Property Assessment Corporation (MPAC). You can also find your assessment roll number by checking the property tax bill, which is usually issued by your local municipality and should include the assessment roll number and other relevant property information.

Type of Residential Property

You must select the type of residential property: Detached house, Duplex, Triplex, Semi-Detached, Townhouse or rowhouse unit, and Residential condominium unit.

Year of ownership

Enter the year that you became an owner of the residential property.

What type of ownership do you have?

Select one of the ownership types: sole owner, joint tenancy, or tenants in common.

Joint Tenancy and Tenants in Common are two ways to own property together.

In Joint Tenancy, co-owners have equal and undivided interest with a right of survivorship, meaning upon the death of one joint tenant, the surviving tenant(s) inherit their share.

In Tenants in Common, each co-owner holds separate ownership with no automatic transfer of ownership upon death; their ownership share is distributed according to their will or intestacy laws. Please get in touch with your lawyer if you are unsure which type of ownership applies to you.

Ownership percentage

If there are multiple owners of the residential property on December 31st, use the indicated percentage from the land registration. If the land registration does not have a percentage, divide 100% by the number of owners.

If the residential property is jointly owned, you must disclose every owner with an ownership interest of 10% or more.

Assessed Value

The assessed value for residential property is established by an authority that has the power under Canadian law to establish the assessed value of the property for calculating a property tax. The value refers to the “full assessed value” of the parcel of real property, of which the residential property is the whole or a part.

Provincial or territorial assessment and property tax regimes vary across Canada. Under a typical assessment and property tax regime, an authority establishes the assessed value of residential properties in its jurisdiction and sends property assessment notices (or similar documents) to the owners. The authority also sends the assessed value of the residential properties to the applicable municipality. The municipality calculates the property tax for residential properties by applying municipal tax rates to all (or part of) the assessed value of the residential properties and then sends property tax bills to the owners.

A property assessment notice (or similar document) and a property tax bill are generally two separate and distinct documents. However, in some parts of Canada, the property assessment notice and the property tax bill may form one single document.

The assessed value of the residential property, as established by the authority, may not necessarily be the same as the value used by the municipality to calculate the property tax. In some parts of Canada, the property tax may be calculated on only part of the assessed value established by the authority. Therefore, use the full assessed value established by an authority and as stated in the property assessment notice (or similar document).

In Ontario, the Municipal Property Assessment Corporation (“MPAC”) assesses property value for the purposes of calculating municipal property tax. The amount you will need to enter is the full assessed value stated on your most recent property assessment notice. In Ontario, MPAC updates property assessments every four years. A notice of assessment is sent to property owners during the year their property assessment is updated. COVID-19 caused the cancellation of MPAC’s province-wide assessment update. As a result, the fixed valuation date for 2022 and 2023 remains January 1, 2016 – the end of the last assessment cycle.

In our example, the assessed value would be $500,000.

Most Recent Sale Price

Enter the most recent sale price on or before December 31st of the year.

In our example, the most recent sale was when Jesse purchased the home for $1 million.

Taxable Value

The “taxable value” is the greater of the assessed value or the residential property’s most recent sale price.

Step 5: Part 3 – Multiple Residential Properties

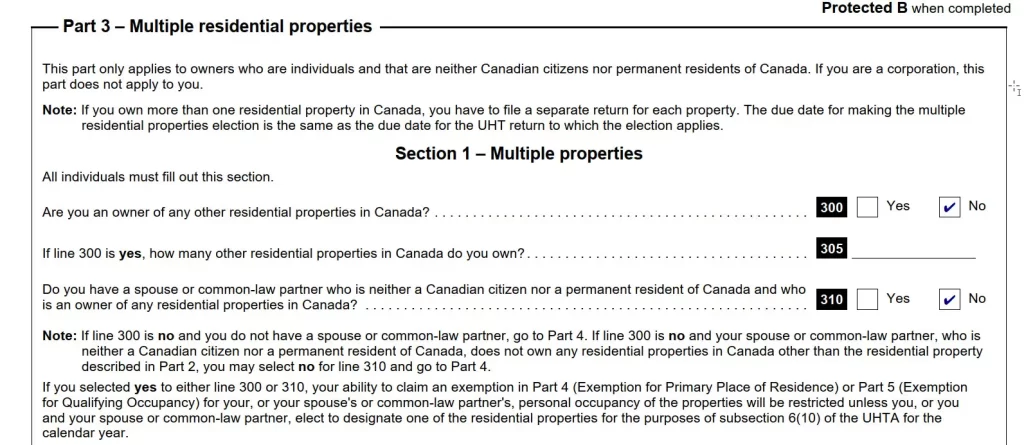

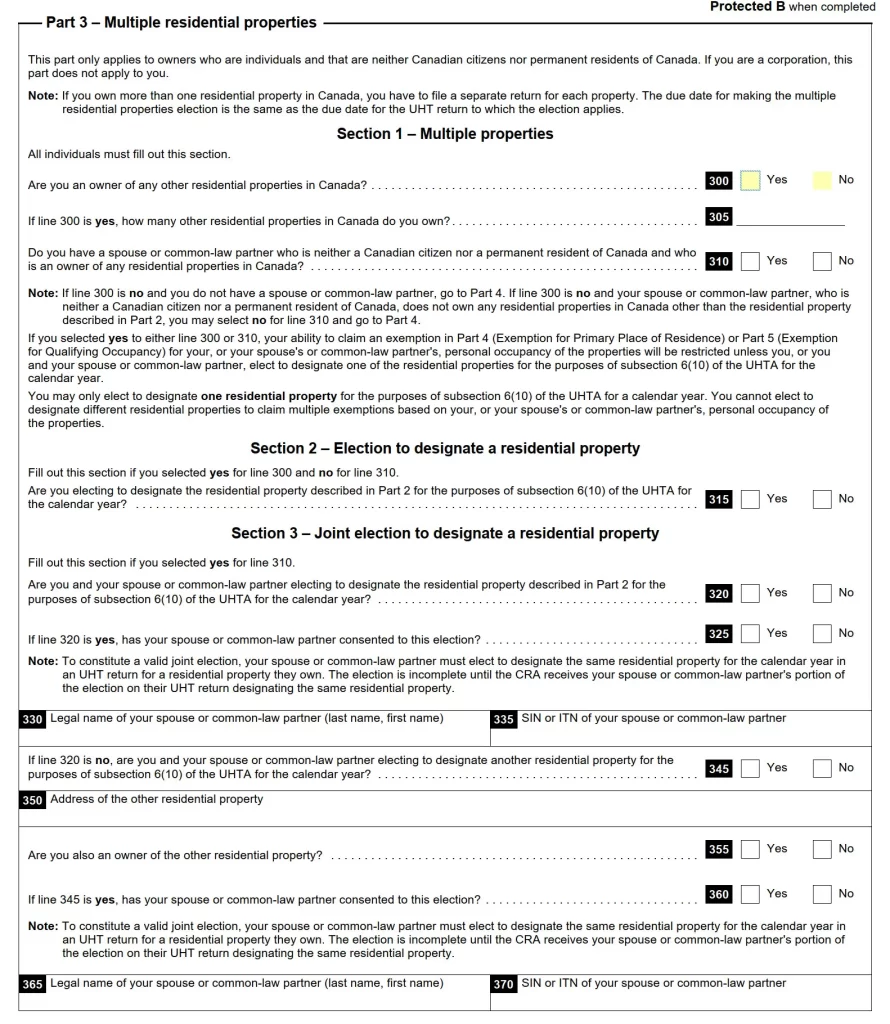

You need to complete Part 3 if you own or your spouse (non-Canadian citizen or permanent resident) together own multiple residential properties in Canada. If you own multiple properties, you must answer the questions on lines 300 and 310 accordingly.

In our example, Jesse or his spouse did not own any other residential properties in Canada, so he will answer “No” to lines 300 and 310.

Step 6: UHT Exemptions

If you qualify for one of the UHT Exemptions listed in the headings below, you will not have to pay the UHT Tax. However, you will still need to file a UHT Return and claim the appropriate exemption.

The following parts of the UHT Return deal with exemptions:

- Part 4 – Exemption for primary place of residence

- Part 5 – Exemption for qualifying occupancy

- Part 6 – Other exemptions

Read through the below headings to see if you qualify for one of the exemptions. We will show you how to claim the exemption on the UHT Return under each heading.

Exemption 1: Exemption for Qualifying Occupancy

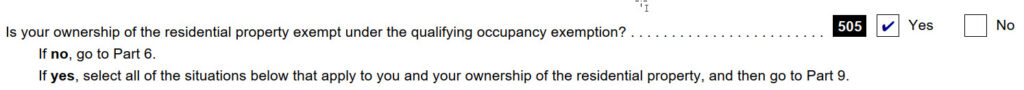

If you qualify for the “Exemption for qualifying occupancy,” complete Part 5 – Exemption for qualifying occupancy.

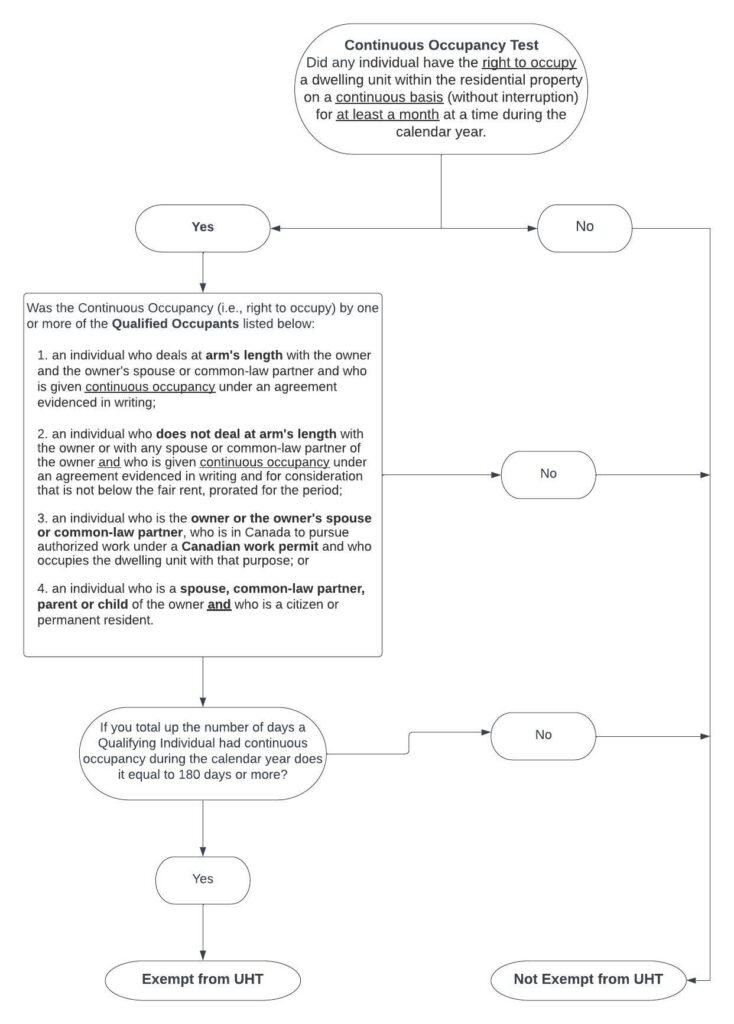

Please refer to Appendix A for a decision tree to see if you meet the Qualifying Occupancy exemption.

A property is exempt from UHT if it passes the “qualifying occupancy test” during the calendar year.

To pass this test, a “qualifying occupant” must have “continuous occupancy” of a “dwelling unit” that is part of the residential property for at least a month at a time, adding up to a total of at least 180 days in a year.

We explain the terms below.

Continuous occupancy is if an individual has the right to occupy a dwelling unit for a period on a continuous basis (without interruption throughout the period). An individual’s continuous occupancy is not necessarily interrupted by the individual’s physical absence from the dwelling unit at a time in the period if it meets all of the following conditions:

- the individual still has the right to occupy the dwelling unit throughout their physical absence

- the right to occupy the dwelling unit is not given to another individual for any part of the physical absence

A dwelling unit is a residential unit that contains private kitchen facilities, a private bath and a private living area.

A qualifying occupant would include the following persons:

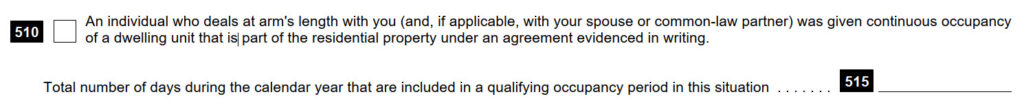

- Line 510 and 515: an individual who deals at arm’s length (not related or independent) with the owner and the owner’s spouse and who is given “continuous occupancy” of the “dwelling unit” under an agreement evidenced in writing. If this applies, you will check off line 510 and enter the number of days of continuous occupancy given on line 515*.

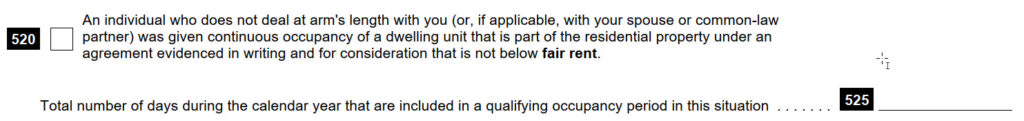

- Line 520 and 525: an individual who does not deal at arm’s length with the owner or with the owner’s spouse and who is given “continuous occupancy” of the “dwelling unit” under an agreement evidenced in writing and for consideration that is not below the fair rent, prorated for the period. If this applies, you will check off line 520 and enter the number of days of continuous occupancy given on line 525*.

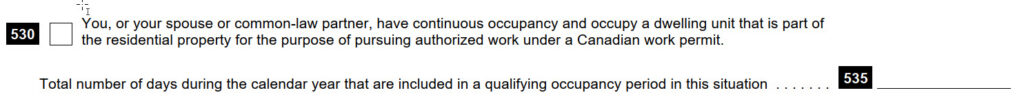

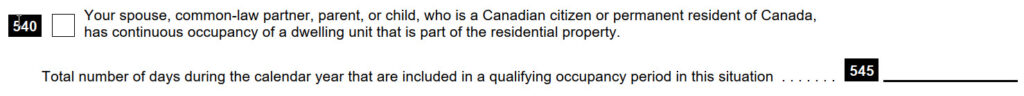

- Line 530 and 535: an individual who is the owner or the owner’s spouse, who is in Canada to pursue authorized work under a Canadian work permit and who occupies the dwelling unit with that purpose (note if you have multiple properties, you will need to elect one of the properties to be eligible for this exemption). If this applies, you will check off line 530 and enter the number of days of continuous occupancy on line 535*.

- Line 540 and 545: an individual who is a spouse, common-law partner, parent or child of the owner and who is a citizen or permanent resident(note if you have multiple properties, you will need to elect one of the properties to be eligible for this exemption). If this applies, you will check off line 540 and enter the number of days of continuous occupancy on line 545*.

*According to the UHT Return, when calculating the total days of qualifying occupancy periods in the calendar year, do not include periods of continuous occupancy that are less than a month.

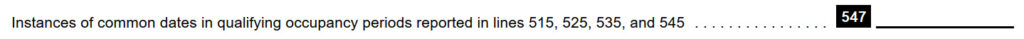

*Any common days of overlapping qualifying occupancy periods are only counted once. You will enter any common dates on line 547.

If a qualifying occupant is an owner or the owner’s spouse, child or parent, the property must be where the individual resides for a longer period in a calendar month than any other place for the month to qualify for the qualifying occupancy test. Suppose you owned Home A and rented Home B. You lived in Home B for more than Home A in January 2022. You would not count the days you lived in Home A in January 2022 for the qualifying occupancy test.

If you own multiple properties, you need to elect one of the properties to be subject to this exemption. You will need to complete “Part 3 – Multiple residential properties.”

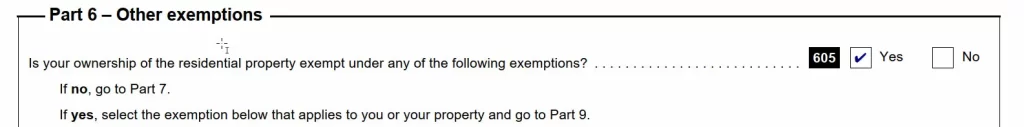

Exemption 2: Exemption for Specified Canadian Corporations

A property owned by a “Specified Canadian Corporation” is exempt from the UHT Tax; however, they must still file a UHT Return.

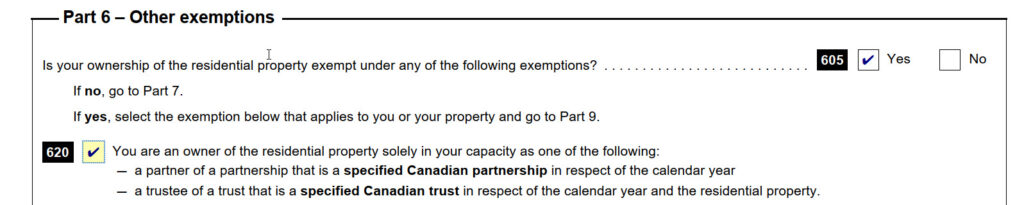

If you qualify for this exemption, complete Part 6 – Other exemptions, and report your exemption by completing line 605 and line 625.

A “Specified Canadian corporation” is a corporation incorporated or continued under the laws of Canada or a province other than a corporation that is, on December 31 of the calendar year:

- a corporation where the following persons have ownership or control, directly or indirectly, of shares of the corporation representing 10% or more of the value of the equity in the corporation or carrying 10% or more of the voting rights under all or under some circumstances:

- an individual who is neither a citizen nor a permanent resident,

- a corporation that is incorporated or continued other than under the laws of Canada or a province, or

- any combination of individuals or corporations mentioned above.

- a corporation without share capital having:

- a chairperson or other presiding officer who is neither a citizen nor a permanent resident, or

- 10% or more of its directors are neither citizens nor permanent residents; or

You first need to determine if the corporation was incorporated or continued in Canada or a province of Canada. If the corporation has issued shares, you need to determine whether a non-Canadian owns 10% or more of the shares giving them votes or values.

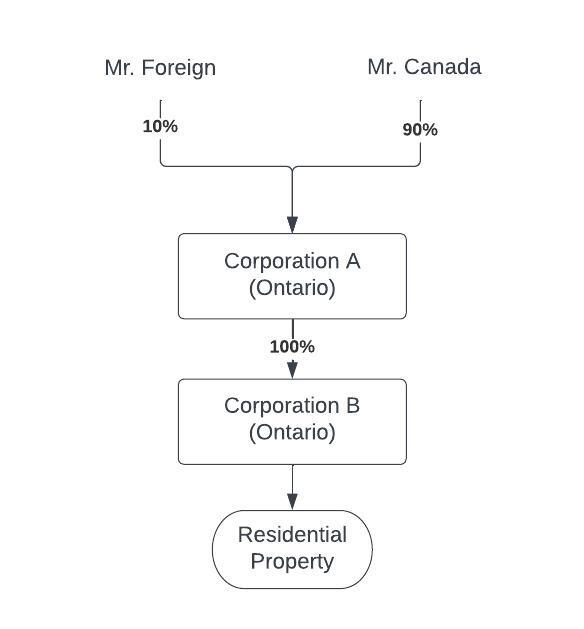

In applying the test, you need to look at direct and indirect ownership. For example, in the ownership structure below, where Corporation A and Corporation B are incorporated in Ontario, Corporation B would not be classified as a “Specified Canadian Corporation.” This is because Mr. Foreign indirectly owns more than 10% of its shares.

Exemption 3: Exemption for Partner of Specified Canadian Partnership

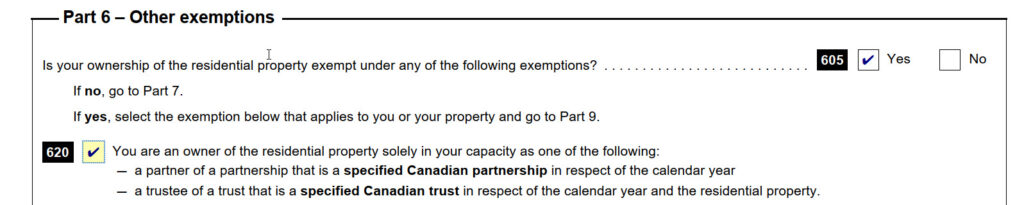

If a partner owns a property in their capacity as a partner in a “Specified Canadian Partnership,” the partner would be exempt from the UHT Tax; however, the partner must still file a UHT Return.

If you qualify for this exemption, complete Part 6 – Other exemptions, and report your exemption by completing line 605 and line 620.

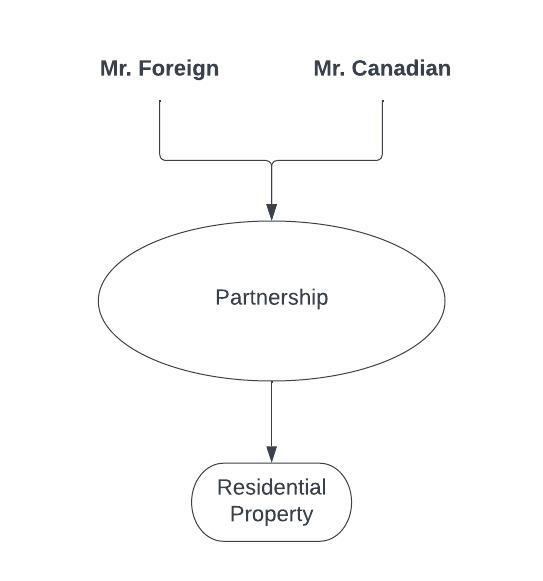

A “Specified Canadian Partnership” is a partnership, each member of which is, on December 31 of the calendar year, an excluded owner or a specified Canadian corporation.

A partnership where all the members are Canadian citizens or permanent residents of Canada would be considered a specified Canadian partnership. The partners would be exempt from the UHT Tax. However, they must still file a UHT Return.

Consider a partnership with Mr. Foreign and Mr. Canadian as partners. This partnership would not be considered a “Specified Canadian Partnership.” Both Mr. Foreign and Mr. Canadian, as registered owners, are obligated to pay the UHT Tax, regardless of Mr. Canadian being a Canadian citizen.

Exemption 4: Exemption for Property Held by Trustee of Specified Canadian Trust

If a trustee owns a property in their capacity as a trustee of a “Specified Canadian Trust,” then the trustee would be exempt from the UHT Tax; however, the trustee must still file a UHT Return.

If you qualify for this exemption, complete Part 6 – Other exemptions, and report your exemption by completing line 605 and line 620.

A “Specified Canadian Trust” is a trust where every beneficiary with a beneficial interest in the residential property is either an “excluded owner” or a “specified Canadian corporation” on December 31st of the calendar year.

Consider a Trust that owns a residential property for the benefit of Jamie and Tony, Canadian citizens. Mr. Canadian is the trustee and the only person identified in the land registration system as an owner of the property. In this case, the trust would be a Specified Canadian Trust because all the beneficiaries are excluded owners (i.e., Canadian citizens). Mr. Canadian would be exempt from the UHT Tax. However, he must still file a UHT Return and report the exemption.

Exemption 5: Exemption for Property Not Suitable for Year-Round Use or Seasonally Inaccessible

An owner’s interest in a residential property would be exempt from the UHT Tax for a calendar year if the property is not suitable for year-round use as a place of residence. A property may not be suitable for year-round use if it is not winterized.

An owner’s interest in a residential property would be exempt from the UHT Tax for a calendar year if the property is seasonally inaccessible because public access is not maintained year-round. For instance, if the access road is not maintained in winter, making it inaccessible.

If you qualify for this exemption, complete Part 6 – Other exemptions, and report your exemption by completing line 605 and line 630 or line 635.

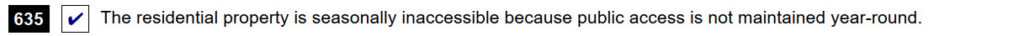

Exemption 6: Exemption for Property Uninhabitable Due to a Disaster or Hazardous Conditions

An owner would be exempt from the UHT Tax for a calendar year if the residential property is uninhabitable for at least 60 consecutive days in the calendar year as a result of a disaster or hazardous condition caused by circumstances beyond the reasonable control of the owner.

This exemption would be available until the conditions affecting the property are resolved, and the property is safe for occupancy to a maximum of two calendar years. If the property remains uninhabitable for two calendar years due to the same disaster/ hazardous condition, it would no longer be exempt.

Even though the owner is exempt from paying the UHT Tax, they must still file a UHT Return.If you qualify for this exemption, complete Part 6 – Other exemptions, and report your exemption by completing lines 605 and lines 640, 642, and 643.

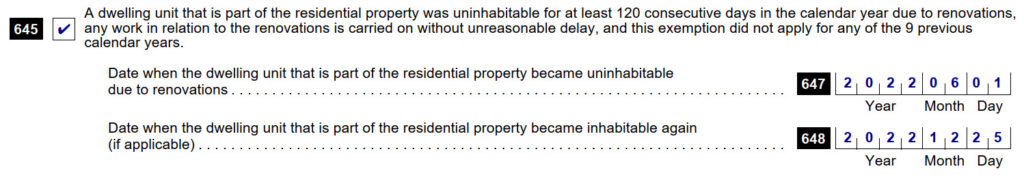

Exemption 7: Exemption for Property Undergoing Major Renovations

An owner would be exempt from the UHT tax if a dwelling unit that is part of the residential property is uninhabitable for at least 120 consecutive days in the calendar year as a result of a renovation to the residential property. The renovation must be carried on without unreasonable delay. The owner must not have used this exemption in any of the nine prior calendar years. In other words, this exemption would only be available once every ten years

Even though the owner is exempt from paying the UHT Tax, they must still file a UHT Return.

If you qualify for this exemption, complete Part 6 – Other exemptions, and report your exemption by completing lines 605 and lines 645, 647, and 648.

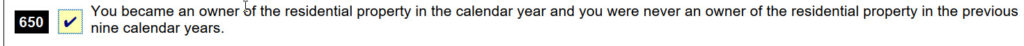

Exemption 8: Exemption for Year of Acquisition of an Interest in Property

An owner would be exempt from the UHT tax if they became an owner of the residential property in the calendar year and was never an owner of the same residential property in the prior nine calendar years.

Suppose an owner acquired a property in Muskoka in 2022. Since they became an owner in 2022, they would be exempt from the UHT tax for 2022. However, this exemption is only valid if they never owned the same property in the prior nine years.

Even though the owner is exempt from paying the UHT Tax, they must still file a UHT Return.

If you qualify for this exemption, complete Part 6 – Other exemptions, and report your exemption by completing line 605 and line 650:

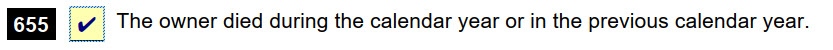

Exemption 9: Exemption for Death

An owner would be exempt from the UHT tax if they died during the calendar year or the prior calendar year. Even though the owner is exempt from paying the UHT Tax, they must still file a UHT Return.

If you qualify for this exemption, complete Part 6 – Other exemptions, and report your exemption by completing line 655:

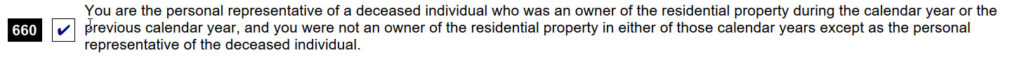

Exemption 10: Exemption for Personal Representative of a Deceased Individual

An owner would be exempt from the UHT tax if they are the personal representative of a deceased individual who was an owner of the residential property during the calendar year or the prior calendar year. In addition, The owner must not have been an owner of the residential property in either of those calendar years.

This exemption would include a situation where the owner is a trustee of the estate of the deceased individual.

Even though the owner is exempt from paying the UHT Tax, they must still file a UHT Return.

If you qualify for this exemption, complete Part 6 – Other exemptions, and report your exemption by completing line 660.

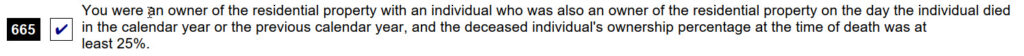

Exemption 11: Exemption upon Death of other Owners

An owner would be exempt from the UHT tax if another owner of the residential property dies, and on the date of death, the other owner has at least a 25% ownership interest in the property. The owner’s interest in the property would be exempt for the calendar year in which the death occurred and for the subsequent calendar year, provided that the owner was an owner of the property on the date of death.

Even though the owner is exempt from paying the UHT Tax, they must still file a UHT Return.

If you qualify for this exemption, complete Part 6 – Other exemptions, and report your exemption by completing line 665:

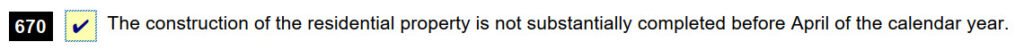

Exemption 12: Exemption for Newly Constructed Property

An owner would be exempt from the UHT tax if the property is a newly constructed property that was not substantially completed before April 1st of the calendar year due to the property being under construction.

The term “substantially completed” is not defined in the Underused Housing Tax Act. The Canada Revenue Agency (CRA) usually considers a house to be substantially complete when construction or major renovations have reached a stage of completion (usually 90% or more) that makes it reasonable for an individual to live there. Minor repairs, adjustments, or remaining upgrades that do not affect the use and enjoyment of the house as a place of residence are not taken into account.

Even though the owner is exempt from paying the UHT Tax, they must still file a UHT Return.

If you qualify for this exemption, complete Part 6 – Other exemptions, and report your exemption by completing line 670:

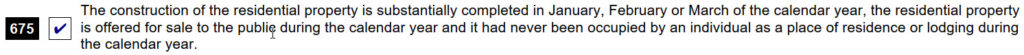

Exemption 13: Exemption for New Property Held by a Developer as Inventory for Sale

An owner would be exempt from the UHT tax if the following conditions are satisfied:

- construction of the residential property is substantially completed in January, February or March of the given calendar year;

- the residential property is offered for sale to the public during the same year; and

- and no one has lived in or used it as a place of residence or lodging during that calendar year.

If you qualify for this exemption, complete Part 6 – Other exemptions, and report your exemption by completing line 675:

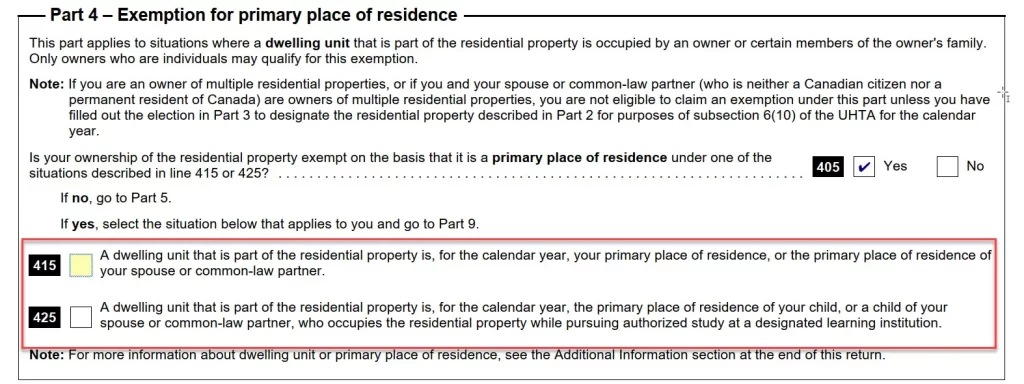

Exemption 14: Primary Place of Residence Exemption

An owner would be exempt from the UHT tax if a dwelling unit that is part of the residential property is, for the calendar year, the primary place of residence of:

- the individual or the individual’s spouse; or

- a child of the individual or the individual’s spouse, and the child occupies the residential property for authorized study at a designated learning institution as defined in section 211.1 of the Immigration and Refugee Protection Regulations. You can find a list by clicking here.

If you qualify for this exemption, complete Part 4 – Exemption for primary place of residence, and report your exemption by completing lines 405, 415, and 425:

Exemption 15: Primary Place of Residence Exemption If You Own Multiple Properties

If an individual owns a particular residential property on December 31st of a given year, and either the individual or their spouse owns additional residential properties (together, these properties are referred to as “specified residential properties“), one additional requirement needs to be met to qualify for the primary place of residence exemption. To qualify for the primary place of residence exemption mentioned above, you will need to file an election to elect one of the properties to be eligible for the exemption.

Suppose the individual’s spouse also owns a residential property. In that case, the individual and the spouse will jointly only designate one of the properties for the exemption. This election or joint election is made under “Part 3 – Multiple residential properties” of the UHT Return. Once you have made the election, you can complete Part 4 – Exemption for primary place of residence, and report your exemption.

For the other properties, in applying for the “qualifying occupancy exemption” (see above), the individual and their spouse would not be considered “qualifying occupants.” Suppose you have two properties. If one of them qualifies for the Primary Place of Residence Exemption, you cannot claim the Qualifying Occupancy Exemption on the other property.

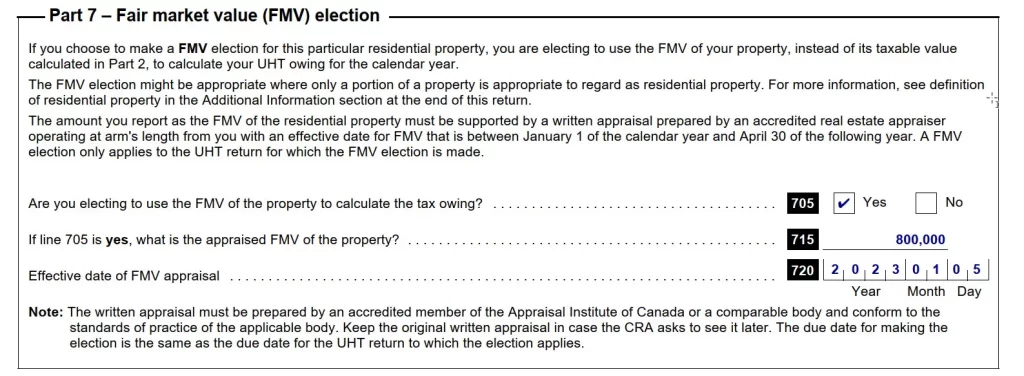

Step 7: Part 7 – Fair market value (FMV) election

To calculate the underused housing tax, each owner of residential property has to apply the 1% tax rate to the “taxable value” of the residential property prorated by their ownership percentage.

The “taxable value” is the greater of the assessed value or the residential property’s most recent sale price as determined under Part 2 – Information about your residential property in Canada.

Rather than using the taxable value, you may elect to use the fair market value of the residential property instead to calculate your underused housing tax. This election is made under “Part 7 – Fair market value (FMV) election.”

The amount you report as the FMV of the residential property must be supported by a written appraisal prepared by an accredited real estate appraiser operating at arm’s length from you with an effective date for FMV that is between January 1 of the calendar year and April 30 of the following year. For example, for 2022, you can use an appraisal with an effective date of January 1, 2022 to April 30, 2023.

In our example, Jesse obtains an appraisal from an accredited real estate appraiser with an effective date of January 5, 2023, for a value of $800,000.

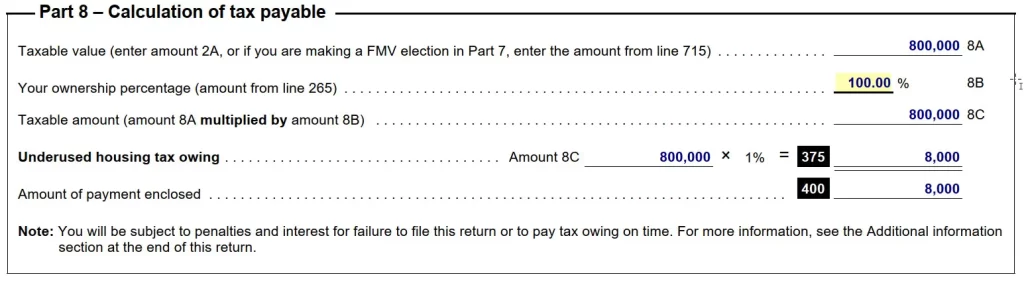

Step 8: Part 8 – Calculation of tax payable

To calculate the underused housing tax, each residential property owner has to apply the 1% tax rate to the “taxable value” or the fair market value if an election is made (see above). The calculation is done under “Part 8 – Calculation of tax payable“.

In our example, the taxable value is $1 million, whereas the FMV after the election is $800,000. To pay lower taxes, Jesse will use the FMV of $800,000. The UHT will equal $8,000.

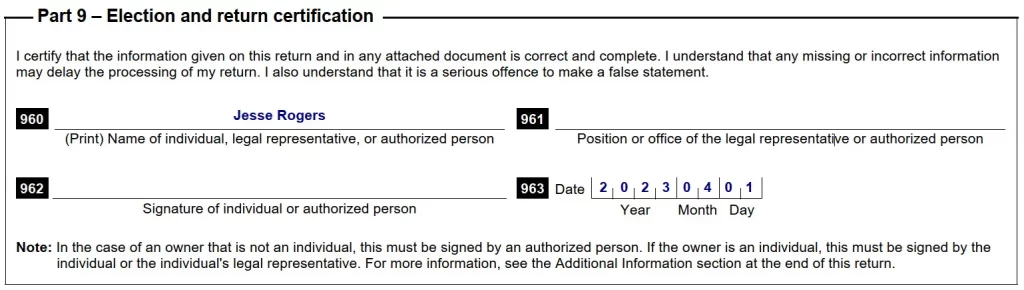

Step 9: Part 9 – Election and return certification

We made it to the end! Here you sign and date the UHT Return.

Step 10: Filing the Return

If you are any of the following:

- An individual who lives in:

- USA, United Kingdom, France, Netherlands, or Denmark

- Alberta, British Columbia, Manitoba, Saskatchewan, Northwest Territories, Nunavut, or Yukon

- the following places in Ontario: anywhere except Barrie, Sudbury, or Toronto

- A corporation located in:

- USA, United Kingdom, France, Netherlands, or Denmark

- Alberta, British Columbia, Manitoba, Saskatchewan, Northwest Territories, Nunavut, or Yukon

- the following places in Ontario: anywhere except Barrie, Sudbury, or Toronto

Send your UHT Return to:

Winnipeg Tax Centre

Post Office Box 14001, Station Main

Winnipeg, MB R3C 3M3 Canada

Fax: 204-984-5164

If you are any of the following:

- An individual who lives in:

- Countries other than the USA, United Kingdom, France, Netherlands, or Denmark

- New Brunswick, Newfoundland and Labrador, Nova Scotia, Prince Edward Island, or Quebec

- the following places in Ontario: Barrie, Sudbury, or Toronto

- A corporation located in:

- Countries other than the USA, United Kingdom, France, Netherlands, or Denmark

- New Brunswick, Newfoundland and Labrador, Nova Scotia, Prince Edward Island, or Quebec

- the following places in Ontario: Barrie, Sudbury, or Toronto

Send your UHT return to:

Sudbury Tax Centre

1050 Notre Dame Avenue

Sudbury ON P3A 5C2 Canada

Fax: 705-671-3994 and 1-855-276-1529

File Electronically

You can also file electronically through the following link: https://apps.cra-arc.gc.ca/ebci/sres/ext/pub/ntrUhtFlng?request_locale=en_CA.

Appendix A: Exemption for Qualifying Occupancy Decision Tree

Take the first step toward success!

Ready to simplify your Underused Housing Tax Return? Schedule your free consultation today and get expert guidance tailored to your needs!