Last week, the Ontario government proposed to cut Ontario’s small business corporate tax rate from 3.5% to 3.2%, effective January 1, 2020. The rate reduction would be prorated for taxation years straddling January 1, 2020.

Corresponding to the rate reduction, the government proposes to reduce the dividend tax credit (DTC) rate on non-eligible dividends from 3.2863% to 2.9863%. As a result, recipients of non‐eligible dividends would receive reduced DTC.

What does this mean?

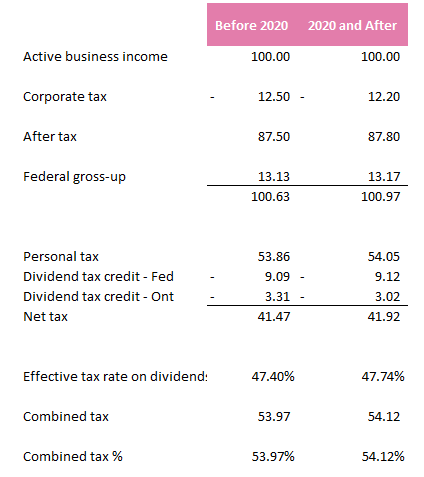

- The good: Lower initial taxes for businesses eligible for the small business deduction.

- Since the DTC is reduced owners who pull money out of the company will face slightly higher combined taxes than before.

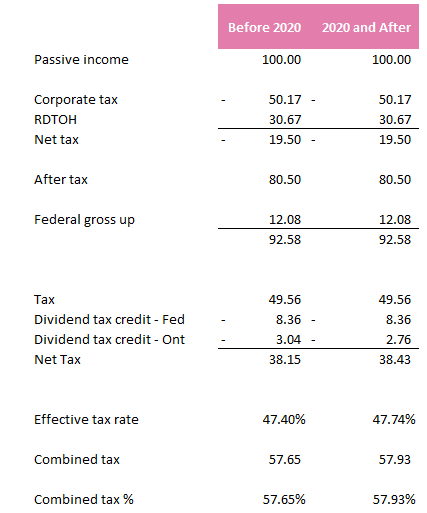

- Given the reduction in the DTC, owners of investment holding companies will face a higher combined tax rate on earning passive income in a corporation.

We highlight examples of the results for individuals in the top tax bracket.

Example 1 – Earning Active Business Eligible for the Small Business Deduction in a Corporation at the Top Personal Tax Bracket

Example 2 – Earning Passive Income in a Corporation at the Top Personal Tax Bracket

Take the first step toward success!

If you have questions or need expert guidance, we’re here to help you every step of the way. Schedule your free consultation today!