Introduction

The reality is that Canada’s tax system is designed to reward corporations. If you want to build your wealth quicker, you will ultimately need to carry your business through a corporation to reap the rewards.

When the time is right, most small business owners carry on their business through a corporation. You probably heard of a corporation, thinking about setting one up, or already have one set up and looking to learn more. Well, you came to the right place. After reading this article you will know exactly how to use a corporation to lower taxes and become wealthier faster.

Many small business owners incorporate. The main reason is that the corporate tax rates are much lower than the personal tax rate. The Canadian economic and tax system is designed to encourage business owners, especially those who operate through small business corporations. We’ve been helping small business owners for over a decade. We can confidently say that those who incorporate grow their wealth much quicker.

As a small business owner in Ontario, you also don’t have the luxury of big pensions or the safety net of working for a large organization. As business owners, you need to take matters into your own hands to grow your hard-earned money and create lasting wealth for your family. This article and many others will show you why getting a good grasp of how corporations work is the cornerstone of building your wealth.

The below is a high-level guide that will help you grow your hard-earned wealth using a corporation while giving you peace of mind. We included a table of contents and many headings to help you find topics faster. Use this article as a reference guide.

Table of Contents

- Introduction

- What is a corporation?

- Articles of Incorporation

- Shareholders

- Directors and officers

- What does all this mean for small business owners?

- 11 Steps to Setting up a Corporation

- Step 1: Incorporate the Corporation

- Step 2: Decide on Shareholders

- Step 3: Open a Bank Account and Credit Card

- Step 4: Subscribe for Shares

- Step 5: Obtain Legal Documents

- Step 6: Picking a Fiscal Year-End for the Corporation

- Step 7: Transfer Your Existing Business to the Corporation

- Step 8: Form your Corporate Minute Book

- Step 9: Update Baking Information to Your Corporation’s Bank & Set up Pre-Authorized Payments

- Step 10: Set up CRA Accounts & HST Registration

- Step 11: Introduce Lawyer to Your Accounting Team

- Maintaining a Corporation & How We Can Help You!

- Drawing Money from your Corporation

- Corporate Tax for Small Business Owners

- Types of Corporations for Tax

- How are Canadian Controlled Private Corporations Taxed?

- What happens when you take money out of the corporation?

- Tax Deferral Advantage of a Corporation

- Why Investing in a Corporation is Cheaper and Powerful for Building Wealth Faster

- Tax Deadlines, Payments, and Penalties

- How to Pay Corporate Taxes to CRA?

- Key Takeaway and Benefits of Incorporating

What is a corporation?

- A corporation is a legal entity that is separate and distinct from its owners (referred to as shareholders).

- Like individuals (you and me), corporations have many of the same rights and responsibilities.

- For example, corporations can enter contracts, lend and borrow money, sue and be sued, hire employees, invest in assets, and pay taxes (usually at a lower rate 😉).

- For this reason, we say that a corporation is a “separate legal entity,” meaning that the shareholders are not held liable for the corporation’s activities. Suppose the corporation gets sued or can’t pay off its debt. In that case, the shareholders risk only losing what they invested in the company. The shareholder’s other personal assets are not at risk.

- Liability protection is the primary legal reason why people incorporate their business.

- We light-heartedly tell our clients that a corporation is like caring for a child. It’s almost like another imaginary person you need to be mindful of.

- So, the next time you make business decisions like buying a car or taking out a loan, you should ask: Should I do this under my own name or in the corporation’s name. This is one of the common mistakes small business owners first make when starting out. They tend to mix personal and corporate activities, including bank accounts.

Articles of Incorporation

- A corporation is formed by filing an Articles of Incorporation with the government, which outlines:

- corporation’s name

- share structure and any restrictions on share transfers

- corporation’s number of directors

- restrictions you might want to set for your business or business activities

- any other provisions.

- The Articles of Incorporation (commonly called “Articles”) is like your corporation’s birth certificate.

Shareholders

- Shareholders are the owners of the corporation.

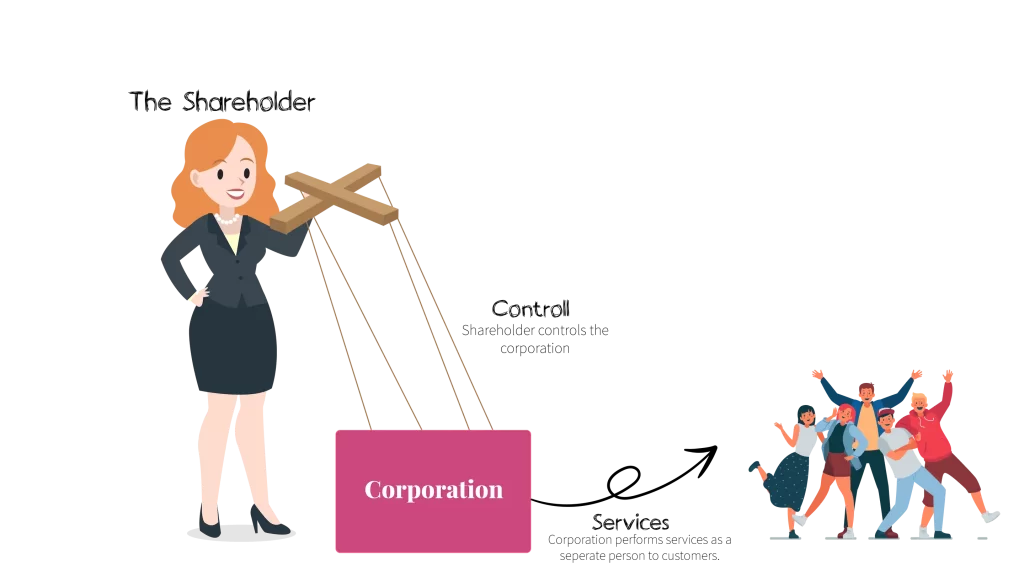

- Like the picture above, you can think of them as puppeteers.

- Shareholders own shares in the corporation. Like you can hold a “share” or a “piece” of a land, you can hold shares in a corporation.

- The shares give the shareholders the right to vote to make decisions and/or receive dividends, along with many other rights (these two are the main rights).

- Note that shares can be: voting or non-voting (i.e., the shareholders who own shares can vote to make decisions on behalf of the corporation)

- Participating or non-participating (i.e., the shareholders who own shares can receive dividends from the corporation)

- Any person can own shares in a corporation.

- A corporation can own shares of another corporation.

Directors and officers

- Directors are responsible for supervising the corporation’s activities and making decisions regarding those activities.

- Directors of a corporation are not required to hold shares in the corporation.

- A director must:

- be at least 18 years old

- not have been declared incapable

- be an individual (a corporation cannot be a director)

- not be bankrupt

- Officers are responsible for the day-to-day operation of the corporation.

- Directors and Officers are usually the people who sign off on things like tax returns, loan documents, etc.

- In most situations, the director and officer will be the business owner (shareholder).

What does all this mean for small business owners?

- In most cases, you (the small business owner) will likely be the voting shareholder (along with family members like your spouse also owing shares), director, and officer of your corporation.

- But know that you wear different hats for legal purposes:

- a shareholder

- director

- officer

- So when you sign off on legal documents or financial statements, you will likely be signing off in your capacity as a director or officer rather than as a shareholder.

11 Steps to Setting up a Corporation

Here are the steps you need to follow to set up a corporation.

We recommend that you solicit an experienced lawyer to set up a corporation. From our experience, we often see small business owners who DIY this process and later get into issues. They also end up paying more money to fix it down the line. Get things right from the beginning, you will have a more peaceful life!

If you are looking for a lawyer, we are happy to suggest some great lawyers who are experienced in setting up corporations.

Don’t let the details below turn you away from incorporation. Usually, the process is seamless when you hire experts like us to guide you. We do this every day!

Step 1: Incorporate the Corporation

- You incorporate by filing the Articles of Incorporation with the Province of Ontario or Federally.

- Once the incorporation is done, make sure to ask your tax advisor to look over the Articles of Incorporation before you file it. The tax advisor will make sure it is set up efficiently from a tax standpoint.

Step 2: Decide on Shareholders

- Decide who will own the voting and non-voting shares of your corporation.

- It may make sense to name your spouse or common-law partner as a shareholder for income splitting purposes. Again, it would be best if you spoke to your tax advisor before deciding on this. There are pro’s and con’s of naming your spouse and other family members as shareholders. One con is that if your spouse or other family members also own a business, they may lose their small business deduction.

- Suppose your spouse is also a small business owner. In that case, we generally suggest setting up a separate corporation to multiply the small business deduction. Generally, cross ownership in each other’s business should be less than 25%, otherwise you need to share the $500,000 small business deduciton limit!

Husband and Wife Share Ownership Pitfall

Small business owners are often quick to add their spouse and other family members as shareholders to split income and save taxes. Although, this practice usually works most of the time. There are some pitfalls to watch out for. We demonstrate – using an example – how Mr. Bond and Mrs. Bond messed this up and ended up paying more tax!

- Suppose Mr. Bond and Mrs. Bond each own 50% in each other’s corporation.

- Suppose the two businesses earn a combined total of $1 million in income. In this case, only $500,000 would be subject to the 12.2% small business rate.

- The remaining $500,00 would get taxed at 26.5%, the general rate.

- Instead of Mr. Bond and Mrs. Bond both getting taxed at 12.2%, one will get taxed at 26.5%. By reduing the cross-ownership to 25%, the Bonds could’ve saved $71,500 in taxes.

Step 3: Open a Bank Account and Credit Card

- You should have a separate bank account in the company’s name. Just take a copy of the articles along with your ID to your bank to set up a bank account.

- Make sure to set up online banking.

- Do you want to take it easy and have your bookkeepers do all your record-keeping without bothering you too much? Then ask the bank if it’s possible to set up a read-only-access for your bookkeeper or accountant. This is possible; we’ve done it many times. You need to get the right contact person at the bank.

- We also recommend getting a credit card in the company’s name. This will make your record-keeping a breeze so you can set up auto payments and separate business from personal transactions. But make sure to pay off your credit cards every month to avoid high interest.

Step 4: Subscribe for Shares

- Your shareholders will need to document putting money in the company in exchange for shares.

- We call this “subscribing for shares.”

- Usually, you subscribe for shares by transferring a small amount like $100 to the corporation.

Step 5: Obtain Legal Documents

- Your lawyer should give you a reporting package. The reporting package includes:

- articles of incorporation,

- by-laws,

- share certificates, and

- the shareholders’ register demonstrates that you and your family members own shares in the company.

- Make sure to ask your lawyer for these documents. Please keep these in your files and send a copy to your accountant and financial advisor. You will need these in the future. They are like your company’s birth certificate!

Step 6: Picking a Fiscal Year-End for the Corporation

- Corporations can choose a fiscal year-end that is not a calendar year-end, unlike individuals who must report their income from January to December every year.

- Corporations, like ordinary corporations, have the freedom to choose any year-end unless the corporation is a member of a partnership. In this instance, the corporation must choose a calendar year-end.

- Once a corporation chooses a year-end, you cannot change it without requesting approval from the CRA.

- From a tax planning perspective, choosing a non-calendar year-end (i.e. any year-end besides December 31) provides the most flexibility. We demonstrate this using the example below.

- Example: Why a non-calendar fiscal year gives you more flexibility:

- A corporation with a year-end from July 1, 2021 to June 30, 2022 will straddle two calendar years (2021 and 2022). For its 2022 fiscal period, this corporation can choose to pay you dividends in (i) the 2020 calendar year, (ii) the 2021 calendar year, or (iii) a combination of both. This allows more tax planning opportunities to spread your income and use up your marginal tax brackets over two years.

- Suppose a corporation chose a year-end from January 1, 2021 to December 31, 2021. In that case, any dividends that the corporation pays during the 2021 fiscal year must be reported in your 2021 personal tax return since individuals must have a calendar year-end.

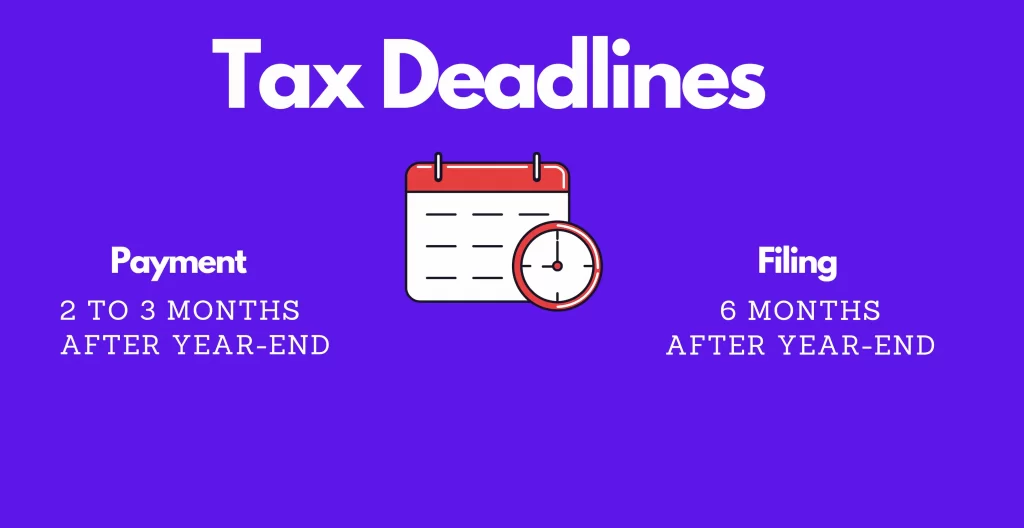

- Aside from tax planning considerations, a choice of year-end can involve other references such as your work schedule and disposable time available to manage your taxes and financial affairs. This is because tax payment is usually due within three months after year-end and your tax return is due within six months.

- If you are unsure what year-end to choose, please reach out to a contact at LRK Tax to discuss a year-end that makes sense for you.

Step 7: Transfer Your Existing Business to the Corporation

- If applicable, after the corporation is incorporated, the small business owners must transfer their existing business (i.e., equipment, inventory, goodwill, customer list) to the new entity.

- You need to get a qualified tax accountant involved here. There is often income taxes and HST on this transfer, but you can avoid these by filing special elections (Section 85 and GST44 GST/HST Election Concerning the Acquisition of a Business or Part of a Business).

- We’re happy to help, we deal with this stuff every day and are leading experts when it comes to this stuff!

- If you were running a business as an unincorporated sole propreitor for some time before incorporating, your business might have accumulated value. For example, if you are a dentist or a real-estate agent, you likely built up a customer list and a brand that has value. You need to think about how to transfer this “intangible” asset to your newly-formed corporation without triggering taxes.

- Suppose you started your practice two years ago as a sole proprietor, and it is now worth $500,000. You built your practice solely on sweat equity. You are now ready to incorporate.

- For tax purposes, when you transfer an asset to a corporation that you control, you are deemed to have sold that asset to the corporation at fair market value (so $500,000). This will be taxed as a capital gain.

- You can avoid paying this tax by filing an election under subsection 85(1) of the Income Tax Act. Make sure to speak to your tax advisor at LRK Tax if you have more questions.

Step 8: Form your Corporate Minute Book

- The above documents form your company’s minute book.

- A minute book is a binder (physical or electronic) that has all your important corporate documents such as the articles of incorporation, the shareholders and directors’ resolutions, share certificates, essential tax filings (such as section 85 elections) by-laws and other legal documents.

- Your lawyer will often maintain your minute book.

- The minute book needs to be updated every year by your lawyer to record your directors declaring dividends, approving tax elections, and approving financial statements. This is required by law.

- Also, keeping your minute books up to date for your corporation will also make tax audits go smoother. CRA may request minute books as part of their audit.

- This is why you should have a good working relationship with an experienced lawyer.

- Make sure to maintain your minute books every year. Although some people fail to keep their minute books up to date and catch up later, they will end up paying a higher price. This is especially true for small business owners who will sell their corporations when they retire. As part of the due diligence process, the buyer’s lawyer will ALWAYS ask to see a copy of the minute book. You don’t want to be catching things up last minute.

Step 9: Update Baking Information to Your Corporation’s Bank & Set up Pre-Authorized Payments

- Once you have formed the corporation, make sure to update your billing informaiton and POS systems to your corporation’s bank account.

- If you’re doing online sales, then make sure to create a seperate Stripe or Paypal account.

- Also, update your payments (membership dues, subscriptions, insurance etc.). to your corporation’s credit card or banking details so that you don’t fall behind on payments. This makes it easier for you to keep track and for your bookkeepers not to miss expenses they can deduct in the corporation.

Step 10: Set up CRA Accounts & HST Registration

- Register for a CRA Business Number (automatic now). You will receive a letter in the mail with your business number. If you haven’t received anything within a week, call CRA at 1-800-959-5525 and ask for your business number. Have your Articles of Incorporation and your latest personal tax return ready, as the CRA agent may ask you to confirm your identity before divulging any information.

- Register for GST/HST (known as, “RT Account”) account (if you need to charge sales tax, usually if taxable sales are over $30,000).

- Register for a payroll (known as, “RP Account”) account (if you have payroll taxes to remit), including salary to yourself and your spouse. See below for more details.

Step 11: Introduce Lawyer to Your Accounting Team

- It would be best to introduce your lawyer to your accounting team. This is so that they can communicate with each other to keep your company in good standing.

- Make sure you work with accountants and lawyers who you can trust and will not run up your fees without first running it by you.

- This is one of the main reasons we advocate fixed monthly subscription pricing. With us, you can take your foot off the gas peddle and have ease of mind that everything is taken care of for an affordable fixed monthly price.

Maintaining a Corporation & How We Can Help You!

1. Cloud Bookkeeping

The reason why we say “Cloud Bookkeeping” instead of just regular “Bookkeeping” is that cloud is the future. If you’re a small business and still using desktop software, know that eventually these will be phased out. The latest and greatest analytical tools to save you time and money will all be on the cloud. That’s why we’re big proponents of preparing our small business clients for the cloud and getting them used to it today!

- Getting a good bookkeeper for your corporation is the first step to lowering your taxes. They can spot things and make sure you are taking advantage of all the tax benefits and deductions out there.

- First and foremost, you need a good bookkeeper who can categorize your transactions and make sure you are making your tax payments. You can take on this task yourself, but we find that small business owners get busy with their business and life. They tend to neglect this task, costing them hundreds of thousands of their hard-earned money.

- We’re here to help. We do your bookkeeping on the cloud using Xero for an affordable price.

- Click here to see why we recommend Xero for small business owners. Xero is a powerful cloud accounting that is new to Canada but has been around in Australia and New Zealand for many years. Xero’s online accounting software is designed to make small business easier.

Look to the Future Not the Past

- We’re different from traditional accounting firms.

- First, we’re all tax specialists. Our core leadership team spent years specializing in complicated in-depth tax planning for small business owners. We worked with some of the wealthiest individuals in Canada, including the top 5 billionares in Canada. We use that knowledge to help small business owners like you because thats our passion and gives us meaning!

- Second, we don’t believe that small business owners should only meet with their accountants once a year to do their taxes and call it a day. We think holistically about your wealth management and advise you on how you can use the tax system to grow your wealth quicker. To do this, we work with real-time information using tools like Xero and our internally developed apps to look to the future so you make the right decisions along the way.

- Third, we use a monthly subscription model to encourage you to work with us on an ongoing basis, and for us to deliver value and business advice/insights throughout the year.

- The benefit of using tax specialists like LRK Tax to do your bookkeeping is that the tax specialists oversee your bookkeeping regularly throughout the year. This is how we are disrupting the traditional way of accounting. If there are timely tax-saving opportunities, we will let you know right away instead of waiting till the end of the year, when you may be surprised with your tax bill, and little can be done. A traditional bookkeeper will let you know how much taxes you need to pay. They may not be able to help you plan and reduce those taxes significantly on a timely basis. We can.

- Because we have hundreds of small businesses on our client roster, we understand your needs better. We can do bookkeeping without getting in your way.

- We also prepare quarterly diagnostic reports that will give you peace of mind and avoid the dreaded year-end tax surprise:

- Are your corporate tax instalments, payroll remittances, and HST payments paid on time?

- Did CRA receive your tax payments and apply them to the correct year and account?

- What are your monthly revenues and expenses? This will give you a sense of your billings and whether you may have forgotten some billings or made any billing errors.

- Do you have a shareholder loan problem?

- What does your personal tax situation look like based on your drawings?

2. Accounting & Financial Statements

- Accountants summarize your bookkeeper’s bookkeeping, and prepare the financial statements and tax return. A good accountant will review the tax return and financial statements and give you advice lower taxes your corporation will pay.

- Traditionally small business owners have used a different firm for their bookkeeping and accounting. Bookkeepers do their work throughout the year. Once that is done, the the business owner will provide that information to the Accountant.

- We’re big proponents that you should have your bookkeeping, accounting, and taxes done under one umbrella. For your accountants to give you meaningful advice, they need to know the details. Accountants need to know these details timely, instead of at the end of the year. Accountants need to be proactive instead of reactive. This may not always be possible when they look at your transactions with a historical lense instead of a forward-thinking lense? This is why we are different. We analyze your bookkeeping data throughout the year and advise you to save taxes throughout the year instead of at the end when it is often too late.

- Ontario’s top marginal personal tax rate is 53.53% (in 2022). If you are reading this post, you are probably serious about growing your wealth and paying the least amount of taxes. In that case, you will need to work with an accountant with a strong tax background who is willing to work with you, your financial advisor, and your lawyer throughout the year. A good accountant should be your personal financial quarterback, linking everything and everyone together. A cookie-cutter accounting solution will not work!

3. Tax Return

- As we mention above, you need to file your T2 Corporate Tax Return within six months after year-end.

- Since your taxes are due within the first two to three months, you should get your taxes done in the first two to three months after your year-end to avoid late payment interest.

- Make sure to provide your Accountant with the information to prepare your financial statements and tax return within the first three months.

4. Legal Resolutions & Updating Your Minute Books

- Your corporate minute book is a binder with all your key legal documents for your corporation.

- CRA sometimes asks to audit the minute books, so keeping your minute books current is essential.

- Make sure to have your lawyer update your minute book every year by your lawyer. This includes documenting your directors declaring dividends, approving tax elections, and approving financial statements. This is required by law.

- Here’s another reason why your Accountant needs to be your financial quarterback. Your Accountant will often prepare a letter to your lawyer with all the information that needs to be updated.

Drawing Money from your Corporation

The primary ways to draw money from the corporation are salary, dividends, and shareholder loans to you and your family members. We discuss each of these below.

Salary

What is a Salary?

- Remember that your corporation is a separate legal person.

- The corporation can pay you for services that you perform on behalf of the corporation. For example, suppose you perform services or sell products to customers through a corporation. In that case, you are working for the corporation. The corporation can pay you a salary for this service.

- The corporation can deduct the salary in computing its taxable income.

- We generally suggest getting a simple employment contract drafted to document the employer-employee relationship between you and your corporation.

CRA Payroll Remittances

- Suppose you decide to take out a salary of $50,000 in 2022. Your net pay will not equal $50,000. This is because the corporation will need to remit payroll taxes to the CRA.

- The corporation would need to remit the following to CRA when it pays salaries:

- Employer CPP

- Employee CPP

- Income Taxes

- The CPP rates change every year. You can find them here.

- For example, if you receive a salary of $50,000, the CPP is calculated as follows:

- CPP in 2022 = ($50,000-3,500) x 5.70% = $2,650.50

- The employer (i.e., your corporation) must match the CPP, so the corporation must pay $5,301 ($2,650.50 x 2) to the CRA. $2,650.50 is withheld from your pay, and the corporation has to fork up another $2,650.50 to match the employee contribution.

- The CPP maxes out when the salary is $64,900 (in 2022). The maximum employer CPP contribution is $3,499.80. The maximum self-employed CPP is $6,999.60 ($3,499.80 x 2 for employer and employee portions).

- On top of CPP, the corporation will need to deduct about $7,400 in income taxes.

- So the net salary in your pocket will be $39,949.50 ($50,000 – 2,650.50 – 7,400).

Payroll Calculators and Tools

- We recommend getting your accountant or bookkeeper to do your payroll calculations. They should give you a monthly schedule that shows your gross salary and CRA remittances.

- But if you choose to do it yourself, we recommend using the CRA Payroll Deductions Calculator.

- Suppose you have multiple employees in your company. If you need a hand, we can help! In that case, we suggest getting your bookkeeper or accountant to handle payroll from start to finish, including payments and remittances to the CRA. The penalties for late remittances could add up to 20%, so we suggest you delegate it to your accountant or bookkeeper unless you have alot of time to devote to this.

Paying Payroll Remittance to CRA

- Don’t forget; you need to make monthly CPP and income tax remittance payments to CRA.

- The due date is normally the 15th of the month following the salary. So if you pay a salary in January 2022, you need to remit the payroll taxes to CRA by February 15, 2022.

- Penalties could be 10% for failing to remit on time and up to 20% if you’re late more than once.

- This is what we suggest:

- Step 1: Make sure you have a payroll account (the “RP Account”) with CRA. If not, ask your accountant to register you for one.

- Step 2: Set up recurring payments through your bank.

- Sign in to your financial institution’s online banking service for businesses.

- Under “Add a payee” look for an option such as:

- Federal Payroll Deductions – Regular/Quarterly – EMPTX – (PD7A)

- Enter your 15-digit business number as your CRA account number (usually ending in RP0001)

- Make sure the number is accurate so that the CRA can apply your payment correctly.

- For our clients we usually give them a monthly payroll schedule they can follow.

Preparing the T4 Slip

- By the end of February of the following year, the corporation must file T4 slips and a summary with the CRA.

- Again, we highly recommend getting your accountant or bookkeeper to do this task. We can always help!

How can we help?

- Payroll could be time-consuming and lots to keep up with.

- We help our monthly subscribing clients with all the above.

- First, we help you decide whether to take salary or dividends and how much.

- Second, we give you a monthly schedule to follow for you and your spouse, so you know how much to remit to CRA.

- Third, we even help you make and set up payments to the CRA so you are never late on your payroll remittances.

- Finally, once everything is done, we prepare a T4 slip.

Dividends

What is a dividend?

- A dividend is when the corporation distributes some of its after-tax earnings to its shareholders.

- The company’s directors determine the amount. See above to see who are “Directors.”

- You can choose to pay out any amount as a dividend so long as the company won’t go bankrupt.

- For example, if you have a big bank loan and pay a dividend, there will not be enough assets (money, real estate, investments, etc.) to repay the loan. Under corporate law, you cannot declare a dividend.

Eligible vs. Non-Eligible vs. Capital Dividends

- There are different types of dividends solely for tax purposes: eligible dividends, non-eligible dividends, and capital dividends.

- Eligible dividends and non-eligible dividends are taxable dividends. This means that when you receive the dividends, you need to pay personal tax on them.

- The tax rate on the eligible dividend is lower than non-eligible dividends.

- Capital dividends are tax-free. You do not need to pay personal tax on them.

- Capital dividends are paid from the capital dividend account (“CDA”). The capital dividend account is equal to 50% of your capital gains. Your corporation can pay 50% of capital gains as a tax-free dividend. This is because only 50% of a capital gain is taxed, so the corporation can pay the non-taxable portion (i.e., the remaining 50%) as a tax-free capital dividend.

- You should work with your accountant, who has a solid background in tax, to see which types of dividends your corporation can pay out.

Preparing the T5 Slip

- Your corporation needs to file the T5 slip and summary with the CRA to report dividends paid from January 1st to December 31st in a given year.

- The deadline to file is by the end of February of the following year.

- If your company paid dividends in 2021, the corporation must file a T5 with the CRA by February 28, 2022.

Salary vs. Dividends

- The biggest difference between salary vs. dividends are:

- Unlike salary, you do not need to remit CPP or taxes on dividends at the source. Instead, you pay the personal income tax on dividends directly or as instalments (see above).

- A corporation pays dividends using the corporation’s after-tax money. First, the corporation pays the corporate tax and distributes some of the remaining money as dividends. Because the corporation has paid some level of tax on this income, when you receive the dividends, you pay tax on such dividends at a lower rate than if you were to receive a salary.

- There is no CPP on dividends.

- Only salary generates RRSP room.

- You or your spouse can only deduct child care expenses on your personal tax return, only if you have a salary or other “earned income.” Dividends do not qualify.

- When the corporation pays a salary, it gets to deduct it when computing its taxable income. This means that part of the income paid as a salary is not taxed in the corporation.

- When you combine the corporate and personal tax of a dividend, they are very close to the total personal tax on a salary.

- We demonstrate this in the example below.

Example – Salary vs. Dividends

- For example, suppose Ross carries on his business through a corporation.

- Suppose the corporation earns $100,000 and has a corporate tax rate of 12.2%. Ross’s marginal tax rate is 30%.

- Case A: Ross wishes to pull all the corporation’s after-tax funds as a salary.

- Case B: Ross wishes to pull all the corporation’s after-tax funds as a dividend.

| Salary | Dividend | |

| Corporation’s income | $100,000 | $100,000 |

| Less: Salary | (100,000) | n/a |

| Corporation’s taxable income | $0 | $100,000 |

| Corporate tax (12.2%) | $0 | ($12,200) |

| After-tax income | $100,000 | $87,500 |

| Ross’s Income | $100,000 | $87,500 |

| Dividend Gross up | 0 | 12,200 |

| Taxable income | $100,000 | $100,000 |

| Personal Tax | (40,000) | (40,000) |

| Dividend tax credit | 0 | 12,200 |

| Net Personal Tax | $40,000 | $27,800 |

| Total Personal + Corporate tax | $40,000 | $40,000 |

| After-tax income | $60,000 | $60,000 |

- Note how dividends and salary have the same income tax.

- The dividend gross-up and dividend tax credit are there to ensure you get credit for the corporate taxes already paid on the $100,000 of earnings so that you don’t get taxed twice on the same income.

- Also, the above example doesn’t show this. But there would be a $7,000 CPP on Salary and no CPP on dividends.

- The Fraser Institute published an informative article on the rates of return you can expect from your CPP contributions. They state that Canadian workers retiring after 2036 (people born in 1972 or after) can expect a rate of return of 2.1% on their CPP contributions.

- If you take dividends instead of salary, you opt out of CPP. If you think you can get a better rate of return than what CPP will give you, then you should consider opting out of CPP by taking dividends (assuming you have no other reason to draw a salary).

Shareholder loans

- Shareholder loans are loans that the corporation gives to its shareholders or family members.

- A shareholder loan is considered to be income of the person who received the loan.

- The exception is that if the person repays the shareholder within one year from the end of the corporation’s fiscal year that the corporation gave the loan.

Example – Shareholder Loans

- Suppose Chandler takes out a $100,000 shareholder loan from his Corporation on March 1, 2022.

- The Corporation has a December 31, 2022 fiscal period.

- Chandler has to repay this loan before December 31, 2023; otherwise, Chandler needs to pay tax on the $100,000 shareholder loan on his 2022 tax return. (Note that if you get taxed and later pay off the loan, you get a deduction in the year you pay off the loan).

Imputed Interest on Shareholder Loans

- Even if you repay the loan, you still need to pay taxes on imputed interest. You need to calculate the interest using CRA’s prescribed rate and pay tax on this amount.

- Suppose Chandler repays the loan (see example above). He still needs to calculate interest for the period that the loan was outstanding and report that income in his 2022/2023 tax return.

Dividends to family members

- Before 2018, it was much easier to split income with family members by paying them dividends from the corporation.

- Since 2018, the Tax on split income (“TOSI”) rules generally made it disadvantageous to pay dividends to family members unless they were involved in the business. The TOSI rules tax dividends paid to family members at the top tax rate (53.53% in Ontario), making income splitting using dividends ineffective.

- There are exceptions to the TOSI rules. We will not discuss it in this article as it is complex. But one of the common exemption is that if a family member works in the business at least an average of 20 hours per week.

- For example, if your spouse works at least 20 hours per week in your business, the corporation can pay a dividend to your spouse to use up his or her marginal tax bracket.

- There are also other exceptions that are beyond the scope of this article, but an experienced tax practitioner will be able to navigate you through the rules.

Salary to family members

- Since the TOSI rules target dividends and not salaries, small business owners may consider having the corporation pay a salary to their spouse.

- A salary will also result in RRSP room for the spouse, which could be a good way to plan for retirement.

- Also, a salary will allow the lower-income spouse to deduct child care expenses. Note that you can only deduct child care expenses against salary or business income. Dividends don’t qualify.

Corporate Tax for Small Business Owners

One of the reasons why small business owners incorporate is for tax reasons. So, you should have a decent understanding of how corporations get taxed so that you are in a position to make wise decisions with your money.

Sure, you can hire good accountants and financial advisors to take care of it all and not know a thing about taxes. You are often the first line of defence. So, in our opinion, you should have a basic understanding of taxes if you are serious about growing your wealth efficiently with the least amount of stress. Knowledge is power.

Types of Corporations for Tax

There are three types of corporations in the tax world. Each of them is taxed differently. The most common corporation type you will deal with is Canadian-controlled private corporations.

Canadian Controlled Private Corporations (CCPCs)

- A Canadian-controlled private corporation (commonly called “CCPC”) is a private corporation that Canadian resident shareholders control.

- Your Professional Corporation and your investment holding company will likely be a CCPC.

- Our tax discussions apply to CCPCs since it’s the most common type of corporation you will be dealing with.

Public Corporations

- Public corporations have a class of their shares listed on a Canadian stock exchange such as the Toronto Stock Exchange (TSX).

- You may invest in public companies like Enbridge, BCE, Rogers, Canadian National Railway.

Other private corporation

- A private corporation is a corporation that is not a public corporation, a CCPC, or controlled by one of these two companies.

- Unless you have non-resident shareholders as part of your corporation, you will likely not encounter this type of corporation.

How are Canadian Controlled Private Corporations Taxed?

It depends on if the corporation earns business income or investment income (interest, dividends, capital gains, rent, and foreign investment income).

Just like individuals, there is a federal and provincial corporate tax.

Business Income

- Business income is taxed favourably in the corporation. Business income would include your money earned from performing medical and dental services minus all your expenses like professional dues, salaries, insurance,

travel, vehicle, equipment rent, and office rent.

| First $500,000 | Income >$500,000 | |

| Business Income | 12.2% | 26.5% |

- The first $500,000 of business income is taxed at 12.2% in Ontario (9% federal small business rate + 3.2% Ontario small business rate). This is accomplished through the small business deduction, which reduces your corporate tax.

- The remaining business income above $500,000 is taxed at 26.5% in Ontario (15% federal general business rate + 11.5% Ontario general business rate).

- Note that if your investment income exceeds $50,000, your federal small business deduction starts to go down by a factor of $5 for every $1 of investment income in excess of $50,000.

- This means that once the corporation earns investment income of $150,000, the entire federal small business deduction is lost. The effective corporate tax rate becomes 18.2% (15% federal rate + 3.2% Ontario small business rate). In this case, the small business deduction grind = ($150,000 – $50,000) x 5 = $500,000.

Investment Income

- Corporate tax rates on investment income are high. The rules are a bit complex, and a complete discussion is beyond the scope of this article.

- The government does not give preferable tax rates on investment income:

- To avoid double taxation when this income is pulled out of the corporation as dividends, all or a portion of the tax is refunded back to the corporation (see refundable portion above).

- The issue is that the compounding is not as high due to the high up-front tax (50.17% on investment income). For example, suppose you invest $100 in a bond that yields a 10% rate of return every year. With a tax of 50% upfront, your after-tax return will only be 5%, which means your investment only compounds by 5%, not 10%. If you reinvest this return, you only have $5 to reinvest, not $10.

- Therefore, all else equal, capital gains investments do the best inside of corporations. This is because capital gains are not taxed until they are sold, effectively compounding tax-free. For example, suppose you invest $100 a stock that grows 10% every year. You decide to hold this for the long term. After one year, your investment will have grown by $10. Since you don’t pay taxes on capital gains until you sell the stock, the stock will effectively compound at 10% per year rather than 5%.

Example: Calculating Corporate Tax

- After this example, you should have a basic understanding of how your corporation gets taxed.

- Suppose Rachel Medicine Professional Corporation earned the following income:

- $1,000,000 from medical services (after deducting expenses)

- $10,000 in foreign investment income

- $10,000 in capital gains

- $10,000 in Canadian dividends from public companies

| Income Type | Amount | Tax Rate | Refundable Portion | Total Tax | Refundable Portion |

| $500,000 eligible for small business deduction | $500,000 | 12.2% | n/a | $61,000 | $0 |

| Business income above $500,000 | $500,000 | 26.5% | n/a | $132,500 | $0 |

| Foreign investment income | $10,000 | 50.17% | 30.67% | $5,017 | $3,067 |

| Capital gains | $10,000 | 25.08% | 15.33% | $2,508 | $1,533 |

| Canadian dividends (eligible dividends) | $10,000 | 38.33% | 38.33% | $3,833 | $3,833 |

| Total | $204,858 | $8,433 |

- Rachel’s professional corporation pays taxes of $204,858.

- $8,433 of the taxes is refundable. The corporation needs to pay dividends of approx. $22,000 to get the total amount back as a refund.

What happens when you take money out of the corporation?

- In theory, there is something called “Integration.”

- No matter which legal structure you earn money in, the tax should be the same when the money eventually makes its way into your pockets.

- So a person who incorporates and a person who doesn’t should ultimately pay the same tax.

- This is best described via an example

Example

- Suppose Bob is a family physician and earns $500,000 as a self-employed individual.

- Bob has a personal tax rate of 40%.

- Suppose Mary is also a family physician and earns $500,000 through a professional corporation.

- Mary also has a personal tax rate of 40%.

- The corporation pays whatever that is remaining as a dividend to Mary.

| Mary | Bob | |

| Corporate income | $500,000 | |

| Corporate tax | (61,000) | |

| After-tax income | $439,000 | |

| Dividends | $439,000 | |

| Business income | $500,000 | |

| Personal tax | (139,000) | (200,000) |

| After-tax income | $300,000 | $300,000 |

Comments

- Notice that the total tax that Mary and her corporation pay equals the total tax Bob pays ($200,000).

- This is called integration.

- The government’s tax policy goal is that Mary and Bob should be on equal footing once Mary pulls all the money from the corporation and gets it into her pockets.

- In reality, as you progress in your busienss/careers, you probably don’t need to pull all the earnings out of the corporation.

- If you can afford to leave money in the corporation, you can defer taxes.

Tax Deferral Advantage of a Corporation

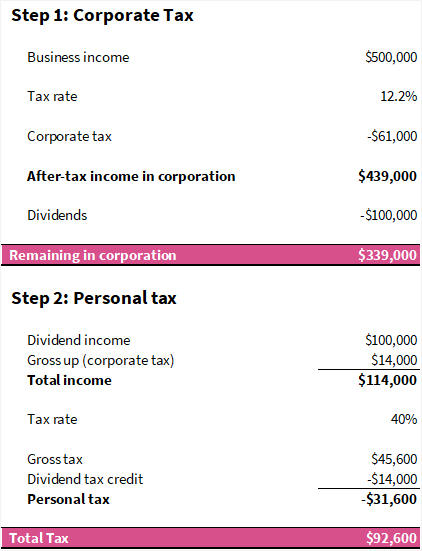

- Suppose Mary only decides to pull only $100,000 out of the corporation and defer taxes.

- The total tax would only be $92,600.

- Mary is able to defer $107,400 of tax until she pulls out the remaining $339,000.

Why Investing in a Corporation is Cheaper and Powerful for Building Wealth Faster

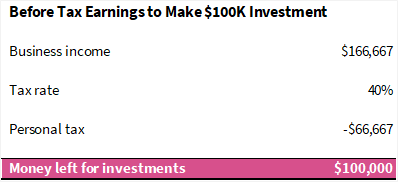

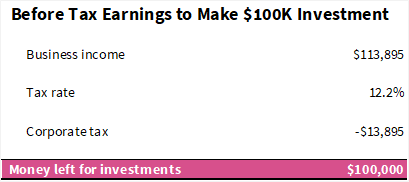

- Suppose Bob and Mary would like to make a $100,000 investment. How much before-tax money do they need to earn in order to make this investment?

Bob

Mary

- Bob must earn almost $53,000 more in before-tax income to have $100K left over to invest!

- Sure, Mary will need to pay taxes when she pulls the money out. But with income-splitting and special tax planning, she can convert this “deferral” into “permanent” tax savings.

- Therefore, we say it’s “cheaper” to invest in a corporation.

- But also consider RRSPs and TFSAs, because it’s a powerful tool due to the tax-deferred growth! Especially for non-speculative type of investments. This is one of the reasons why many small business owners have done well with real-estate investments in Ontario when they invested through the corporation.

- We have sophisticated calculators in-house at LRK Tax and are happy to run the numbers for you. We can tell you exactly how much your investments will be at the time of retirement based on a given rate of return.

Tax Deadlines, Payments, and Penalties

Income Tax Return Filing Deadline

- Corporations have to file an annual corporate tax return called the T2 Return.

- The T2 Return is due six months after your fiscal year-end. If you chose a June 30th fiscal year-end, you would need to file your corporate tax return on or before December 31st.

Late Filing Penalties

- If you file your return late, a penalty applies.

- The penalty is 5% of the unpaid tax due on the filing deadline, plus 1% of this unpaid tax for each complete month that the return is late, up to a maximum of 12 months.

- Therefore the maximum penalty is 17%.

- Pro-tip is that if you are planning on filing late for whatever reason, make sure to estimate your taxes and possibly add a bit of a buffer to that amount. This will eliminate or reduce your late filing penalty.

Corporate Tax Payment Deadline

- Small businesses (income under $500,000) usually have to pay their corporate taxes three months after the fiscal year-end. So, for example, if the corporation has a June 30, 2022, fiscal year-end, the corporate tax would be due September 30, 2022.

- Corporate tax instalments for large businesses (income over $500,000) or investment holding companies are usually due monthly. So, for example, if the corporation has a June 30, 2022, fiscal year-end, its first instalment payment for 2023 will be due July 31, 2022.

- You may wonder how you would know your corporate taxes without filing your corporate tax return (since it is not due until six months). We usually advise our clients to file their tax returns within three months.

- Suppose you cannot file your tax returns within the first three months. In that case, we usually calculate an estimate for you, and you would top up your payments when you file your tax return.

- CRA charges interest on late payments. You can find the interest rates here.

Corporate Tax Instalments

- A corporation must make corporate tax installments if its taxes owing are more than $3,000.

- Most corporations will have to pay corporate tax instalments.

- An instalment payment is a partial payment of the total amount of tax payable for the year.

- Corporate tax instalments for small medical and dentistry practices (income under $500,000) are usually due quarterly. So, for example, if the corporation has a June 30, 2022, fiscal year-end, its first instalment payment for 2023 taxes will be due September 30, 2022.

- Corporate tax instalments for large businesses (income over $500,000) or investment holding companies are usually due monthly. So, for example, if the corporation has a June 30, 2022, fiscal year-end, its first instalment payment for 2023 taxes will be due July 31, 2022.

Late Instalment Interest and Penalties

- If you pay your corporate tax instalments late, you may also face interest and penalties.

- The CRA interest rate varies every quarter, but you can find them here.

- CRA calculates interest from the day the instalments are due to the day you pay the instalments.

- One way to reduce the instalment interest is to overpay your next instalment balance. This is because the CRA gives you an interest offset. But, the instalment interest offset rate is less than the overdue interest (i.e., in 2022 Quarter 1, it

is 1% offset vs. 5% late payment interest) - There is also an instalment penalty when instalment interest is more than $1,000.

- Instalment Penalty = 50% x Instalment Interest Owing – Greater of ($1,000 or 25% of interest calculated as if no instalments had been paid).

- So, if you let your installment payments build-up, you may have a penalty on top of the interest. This could become costly!

How to Pay Corporate Taxes to CRA?

Most Common Way to Pay CRA

You can make a payment online, in person, or by mail. You can learn more about it here.

Most people tend to pay using online banking. These are the instructions:

- Sign in to your bank’s online banking service for businesses.

- Under “Add a payee” look for an option such as:

- Federal – Corporation Tax Payments – TXINS;

- Federal – GST/HST Payment – GST-P (GST-P);

- Federal Payroll Deductions – Regular/Quarterly – EMPTX – (PD7A)

- Enter your 15-digit business number as your CRA account number:

- Corporate Tax: 123456789 RC000#

- HST: 123456789 RT000#

- Payroll: 123456789 RP000#

- Ensure the business number and account code is accurate so that the CRA can apply your payment correctly.

Third-Party Providers

- Suppose you want to pay using a credit card. In that case, you need to use a third-party service provider like PaySimply or Plastiq (these are the two suggested on CRA’s website).

- These providers offer payment by credit card, debit card, PayPal, or Interac e-Transfer.

- They charge a fee (1% to 2.5%) for their services. The third-party service provider will send your individual or business payment and remittance details online to the CRA for you.

Key Takeaway and Benefits of Incorporating

Now that we learned all we needed to know about corporations, here are the takeaways and benefits of incorporating:

- Lower corporate tax rates due to the small business deduction

- Ability to choose to pay dividends, effectively opting out of CPP

- More money to invest in a corporation

- Liability protection

- Ability to have family members as shareholders to split income

- For sellable businesses, the ability to access the lifetime capital gains exemption, which allows you to pay no tax on the sale of the shares of your professional corporation (up to a sale price of approx. $900,000).

- Ability to multiply the lifetime capital gains exemption with family members.