The recent measures released by the government of Canada to combat the negative fallout from COVID-19 provides some relief to owner-managers of small businesses. While these measures do help, owner-managers may also position themselves in a better financial position by considering the following:

Stop paying yourself a salary

Owner Managers who pay themselves a recurring salary may be able to improve their cash flow by replacing their salary with dividends. Salaries require source deductions to be withheld, and these must be remitted to the government generally on a monthly basis. However, there are no withholdings required when a corporation pays a dividend to a Canadian resident shareholder.

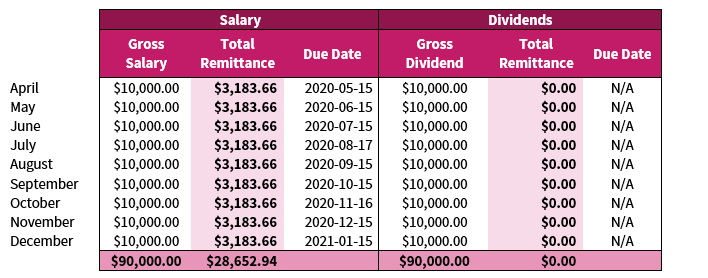

Assume a corporation, which has a December 31, 2020 year-end, and is owned by an owner-manager shareholder who pays himself an annual salary of $120,000 per year or $10,000 per month. As of April, the owner-manager has a choice to choose between salaries and dividends:

As demonstrated above, if the owner-manager continues to pay himself or herself a salary, there will be a cash outflow of almost $3,200 per month that will be remitted to the government. This precious cash reserve may be retained temporarily in the corporation by switching over to dividends to avoid these monthly remittances. The personal tax attributable to this dividend will still be payable, however, the owner-manager has until April 30, 2021, to pay this amount, which permits a one-year deferral and allows the corporation to retain cash to ride out the uncertain economic landscape.

In addition to retaining cash in the corporation, the owner-manager who is no longer earning employment income MAY be able to access the Emergency Care Benefit of $900 bi-weekly for up to 15 weeks. Ordinarily, owner-managers who pay themselves a salary are exempt from employment insurance premiums and are otherwise engaged in non-insurable employment. Interestingly, based on the latest CRA release, the Emergency Care Benefit provides income support to:

- Workers, including the self-employed, who are quarantined or sick with COVID-19 but do not qualify for EI sickness benefits.

- Workers, including the self-employed, who are taking care of a family member who is sick with COVID-19, such as an elderly parent, but do not qualify for EI sickness benefits.

- Parents with children who require care or supervision due to school or daycare closures, and are unable to earn employment income, irrespective of whether they qualify for EI or not.

Based on the above, access to these benefits appears to be dependent on the existence of employment income rather than dividend income. If an owner-manager who did not contribute to EI and would not otherwise be eligible for EI no longer earned employment income, the emergency care benefits may be accessible to that owner-manager who switched from salaries to dividends. Formal legislation has yet to be released so whether the above is permissible is uncertain.

Paying family members including children

The Canada Revenue Agency has historically challenged remuneration payments to children and family members as unreasonable in some instances and prevented the deduction of such amounts in the corporation. School closures have necessitated the need for children to spend time with parents working from home or at the family business, and in some cases, the children may help out with smaller tasks related to the earnings of a particular business.

An opportunity may be available to pay these individuals a sum to compensate them for their time. Consider a business such as a restaurant take out business who now have three children helping out because schools have closed and are not permitted to spend time anywhere else due to social distancing concerns.

A modest salary of $10,000 each to the three children would not attract any personal tax since the amounts are below the basic personal amount for the three children. Even if the CRA denies the deduction in the corporation due to reasonability, there is no exposure since the children are not paying any personal tax in any possible scenario.

Perhaps a greater motivation to pay these salaries would be to access the Temporary Wage Subsidy. The withholding tax requirements imposed under the Income Tax Act mandate a minimum withholding tax requirement but does not preclude the employer from withholding more. The three children will not fill out TD-1 and the owner-manager of the business may withhold 10% on each of the $10,000 of salaries but not remit these withholdings for the period between March 18, 2020 to June 20, 2020. Other than CPP considerations, this transaction is cash neutral. However, when the three children file their taxes by April 30, 2021, they can expect a refund of $1,000 each so that the family will receive a cash injection of $3,000 by 2021 to help strengthen their business.

Again, the legislation has not been released to confirm whether the above is permissible.

If you have any questions or concerns, please don’t hesitate to reach out to our team at LRK Tax.