Recent changes to capital gains inclusion rates have introduced complexities for corporations managing their Capital Dividend Account (“CDA”). Understanding these changes is crucial as they could result in significant unexpected penalties.

Understanding the Capital Gains Inclusion Rate Change

Under the current draft legislation, the capital gains inclusion rate is set at 2/3 for the taxpayer’s gains for the entire fiscal year. Transitional rules apply this rate to taxation years ending after June 24, 2024. For fiscal years that include June 25, 2024, such as January 1, 2024, to December 31, 2024, the inclusion rate is determined based on net gains or losses in two periods: Period 1 (January 1, 2024, to June 24, 2024) and Period 2 (June 25, 2024, to December 31, 2024).

First, you calculate the “net capital gain” and/or “net capital loss” in two periods: Period 1 (“P1”) from the start of the tax year to June 24, 2024, and Period 2 (“P2”) from June 25, 2024, to the end of the tax year. Then, the capital gains inclusion rate for the entire tax year is determined using the following rules:

| Condition | Capital Gains Inclusion Rate for the Entire Tax Year |

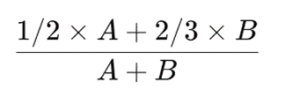

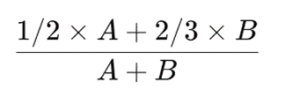

| Only net capital gains P1 and P2 |  |

| Only net capital losses P1 and P2 |  |

| Net capital gains and losses are $0 in P2 and P2 | 2/3 |

| Net capital gains in P1 > net capital losses in P2 | 1/2 |

| Net capital losses P1 > net capital gains P2 | 1/2 |

| Net capital gains P1 < net capital losses P2 | 2/3 |

| Net capital losses P1 < net capital gains P2 | 2/3 |

In the above:

- A = Net capital gains or net capital losses from the first period.

- B = Net capital gains or net capital losses from the second period.

- The taxpayer’s net capital gains for a period are the amount by which their capital gains exceed their capital losses in that period.

- The taxpayer’s net capital losses for a period are the amount by which their capital losses exceed their capital gains in that period.

Example

Suppose ABC Inc. has a fiscal period ending December 31, 2024. Suppose the net capital gain in P1 (from January 1, 2024, to June 24, 2024) is $100,000 and $200,000 in the second period (June 25, 2024, to December 31, 2024). The inclusion rate would be approximately 61.11% using the formula above, which applies for the entire fiscal period from January 1, 2023, to December 31, 2023.

Therefore, the taxable capital gain is calculated as follows:

| Period | Capital Gain | Inclusion Rate | Taxable Capital Gain |

| Period 1 | $100,000 | 61.11% | $61,111.11 |

| Period 2 | $200,000 | 61.11% | $122,222.22 |

| Total | $300,000 | 61.11% | $183,333.33 |

Most people expected the rules to apply a 1/2 inclusion rate to the $100,000 capital gain in P1 and a 2/3 inclusion rate to the $200,000 capital gain in P2 rather than using a blended rate for the entire gain.

Problem with Capital Dividends and Inclusion Rate

Even though the final taxable capital gain ($183,333.33) works out as expected, this has unintended negative consequences when determining the Capital Dividend Account (“CDA”).

Private corporations use the CDA to track non-taxable capital gains. From the CDA, corporations can pay capital dividends out of the CDA balance to shareholders, allowing them to receive tax-free income. The CDA is evaluated at a specific point in time to determine the balance available for paying out tax-free capital dividends. This means that when a corporation wants to declare a capital dividend, it must check the CDA balance at that particular moment to ensure there are sufficient non-taxable capital gains to cover the capital dividend.

Very generally, the CDA at a point in time is calculated as the corporation’s capital gain minus the taxable capital gain. Assuming that ABC Inc. had a $0 CDA balance at the start of the year, the CDA balance at the end of P1 (June 24, 2024) would only be $38,888.89 instead of what most would have expected of $50,000.

| Period | Capital Gain | Inclusion Rate | Taxable Capital Gain | CDA Addition |

| Period 1 | $100,000 | 61.11% | $61,111.11 | $38,888.89 |

| Period 2 | $100,000 | 61.11% | $122,222.22 | $77,777.78 |

| Total | $300,000 | 61.11% | $183,333.33 | $116,666.67 |

If the corporation had paid a $50,000 capital dividend to its shareholders on June 24, 2024, then it would have paid too much! The practical issue is that the corporation cannot accurately determine the exact amount to be added to the CDA until the end of the year when all capital gains and losses for both periods are known.

Penalties for Excess CDA

If a corporation declares a capital dividend exceeding its CDA balance, it faces a penalty equal to 60% of the excess amount declared. In our example, if the corporation declares a $50,000 dividend in P1 but the actual CDA balance is only $38,888.89, the excess amount of $11,111.11 would result in a penalty of $6,666.67.

Potential Solution or Work Arounds

To manage this uncertainty, a conservative approach can be taken by initially estimating the inclusion rate at the higher end (2/3). If, at year-end, the actual inclusion rate is lower, the CDA can be adjusted accordingly.

For instance, initially estimating an inclusion rate of 2/3 for a $100,000 gain in the first period would result in an estimated taxable gain of $66,667 and a CDA addition of $33,333. After realizing additional gains of $200,000 in the second period and recalculating the inclusion rate to 61.11%, the actual CDA addition would be $116,667, requiring an adjustment of $83,334.

Another solution is to create a fiscal period ending on or before June 24, 2024. This could be done by amalgamating two or more corporations or by transferring appreciated assets to a holding company with a fiscal period ending on or before June 24, 2024, before realizing gains. This allows the taxpayer to close off the current taxation year before June 24, 2024, thus avoiding the split-period calculation of the inclusion rate for capital gains. The issue here is that this may not be practical, given the complexity and only a few more days left.

Will Finance Fix This?

We understand that the Department of Finance is aware of technical issues like the above. However, no one knows for sure if they will fix it or not. Updated draft legislation will be made available at the end of July 2024, and we will need to wait until then to see if the government will fix it. Until then, it may be a good idea to only add 1/3 of the capital gains realized in P1 to the CDA balance.